Stock market

What is a stock market?

A stock market refers to the public marketplaces where stocks are issued, bought, and sold. It’s a vital part of the global economy where companies can raise capital and investors can get in on the growth.

History of stock markets

Stock markets have been around since the 17th century. The first modern stock exchange was set up in Amsterdam in 1602. Since then stock markets have come a long way, and have gone global and technological.

Stock market in the economy

- Capital formation: Companies can raise funds for growth and expansion

- Price discovery: Determines the fair value of securities

- Liquidity: Investors can buy and sell securities easily

- Economic indicator: Reflects overall economy and investor sentiment

Financial markets, including stock markets, play a crucial role in capital formation, price discovery, liquidity, and as economic indicators.

Basic concept

Stocks and shares

Stocks represent ownership in a company. When you buy a share, you’re buying a small piece of that company and become a shareholder.

Understanding stock market basics is essential for anyone looking to invest in stocks, including concepts like indices, strategic investing, and essential terms.

Bulls and bears

“Bulls” are the optimistic ones who think the market will go up, and “bears” are the pessimists who think it will go down. These terms also describe market trends: the bull market is when prices go up, and the bear market is when prices go down.

Market indices

Market indices like S&P 500 or Dow Jones Industrial Average are tools to measure the performance of a group of stocks and give you a snapshot of the overall market trend.

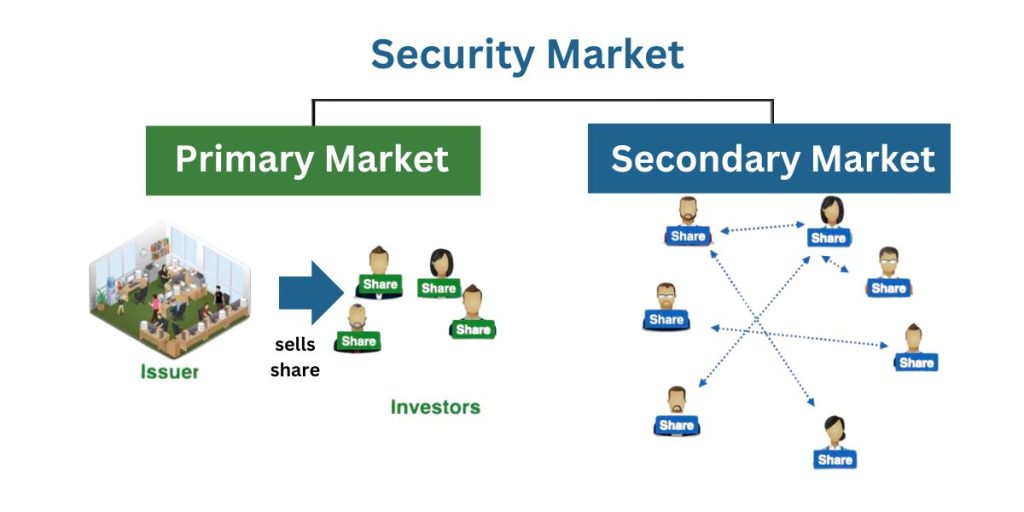

Types of markets

- Primary market: Where new securities are issued and sold by companies themselves

- Secondary market: Where previously issued securities are bought and sold between investors

Latest Trends

- ESG (sustainable and ethical investing)

- Retail investors and commission-free trading platforms

- Cryptocurrencies and blockchain

- Artificial intelligence and machine learning in trading strategies

Market Players

Investors

Individuals or institutions that buy securities for long-term financial goals.

Traders

Those who buy and sell securities frequently for short-term profit.

Brokers and dealers

Intermediaries who facilitate trades between buyers and sellers.

Regulators

Government bodies that oversee the market to ensure fairness and protect investors.

Stock Market Operations

How stocks are traded

Stock market trading involves buying and selling stocks through exchanges, with buyers and sellers matched through an order system. Most trading is done electronically so trades happen fast.

Order types

- Market: Buy or sell at the current price

- Limit: Buy or sell at a specific price or better

- Stop: Become market when a price is hit

- Stop-limit: Become limit when a price is hit

Trading mechanisms

Stock exchanges use different mechanisms to match buyers and sellers, continuous trading, and periodic auctions. Many exchanges now use electronic order books to match trades automatically.

Settlement

After a trade is done, there’s a settlement period (T+2, 2 business days after the trade) where the money and securities are exchanged.

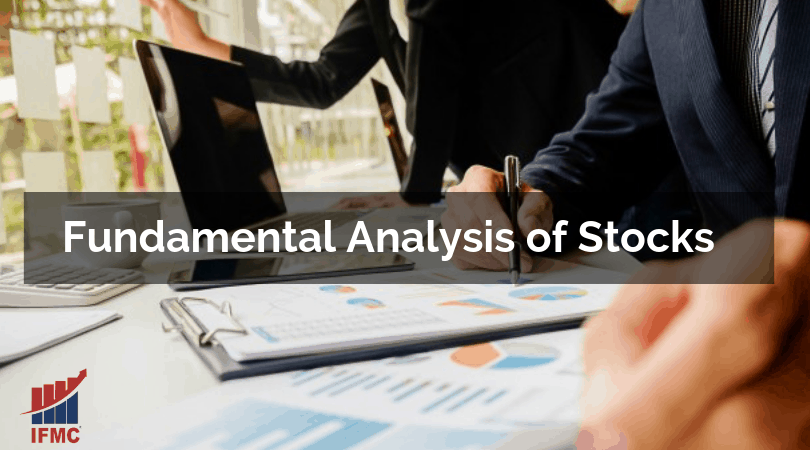

Fundamental Analysis

Financials

The basic analysis involves looking at a company’s financials:

- Balance Sheet: Assets, Liabilities, Shareholders’ Equity

- Income Statement: Revenues, Expenses, Profits

- Cash Flow Statement: Cash Inflows, Cash Outflows

Ratios

Basic ratios used in the basic analysis:

- P/E Ratio

- Debt to Equity Ratio

- ROE

- Current Ratio

Industry

Looking at industry trends, competition, and growth prospects to see where the company sits in its sector.

Economic indicators

Analyzing broader economic factors such as GDP growth, inflation rates, and interest rates to understand their potential impact on stock performance.

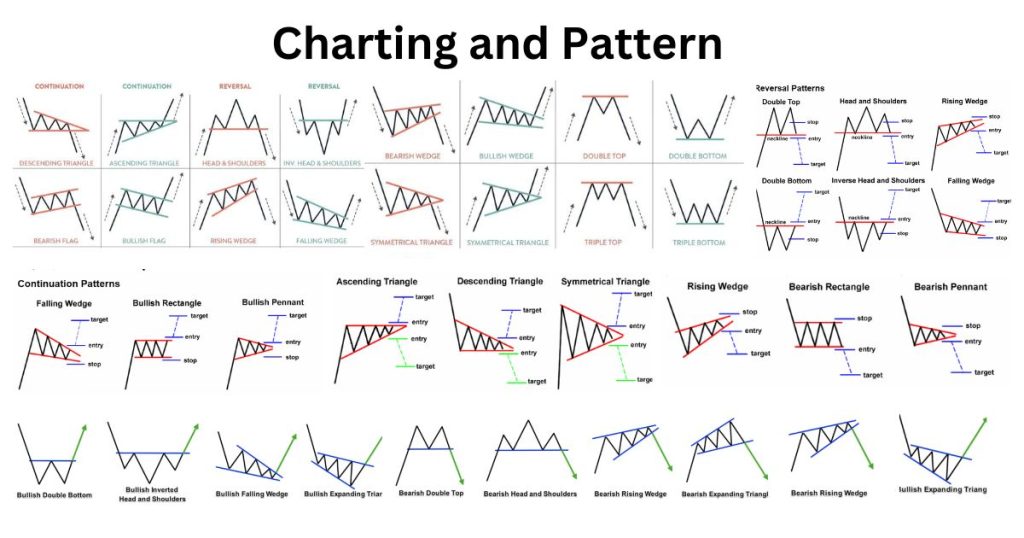

Technical Analysis

Chart patterns

Technical analysts study chart patterns to predict future price movements. Common patterns include:

- Head and Shoulders

- Double Tops and Bottoms

- Triangles (Ascending, Descending, Symmetrical)

- Cup and Handle

Technical indicators

These are mathematical calculations based on price and/or volume to provide trading signals:

- Moving Averages

- Relative Strength Index (RSI)

- Moving Average Convergence Divergence (MACD)

- Bollinger Bands

Trend analysis

Identifying and following the direction of price movements over different time frames.

Support and resistance levels

Price levels where a stock has historically had difficulty falling below (support) or rising above (resistance).

Valuation Method

Price-to-Earnings (P/E)

P/E ratio compares stock price to earnings per share. A quick way to see how expensive a stock is to its earnings.

Discounted Cash Flow (DCF)

DCF calculates the value of an investment based on expected future cash flows. Used to calculate the present value of a company.

Dividend Discount Model (DDM)

DDM values stock based on the present value of future dividends. Good for stable dividend-paying companies.

Comparable company analysis

This method compares a company’s financials to similar companies to see its value in the market.

Investment Strategies

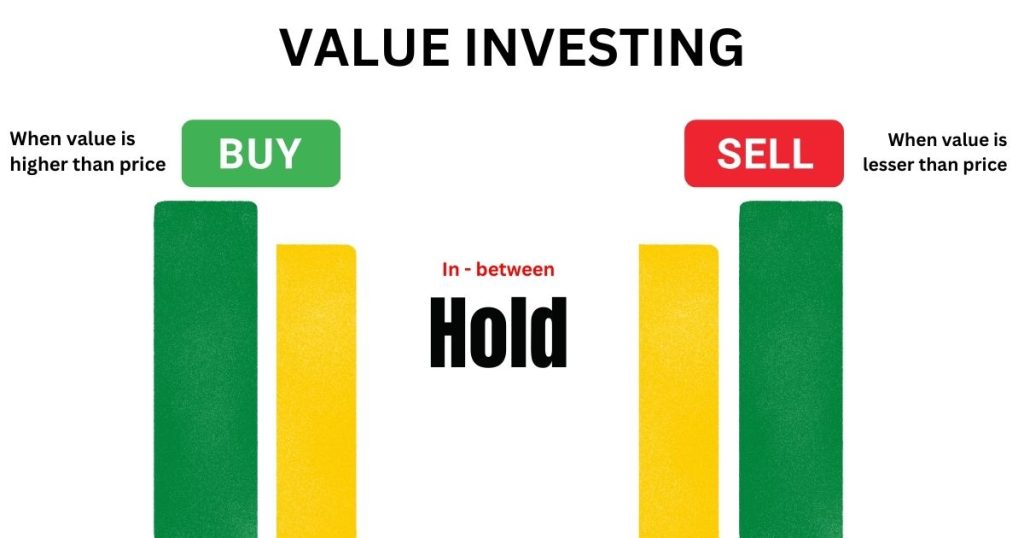

Value Investing

Value investors look for stocks that are undervalued to their intrinsic value. They look for companies with strong fundamentals at a discount.

Growth investing

Growth investors look for companies with high growth potential, often in emerging industries or with new products.

Income investing

This strategy looks for investments that generate regular income, like dividend stocks or bonds.

Momentum investing

Momentum investors try to ride existing trends, buy stocks that are going up and sell those that are going down.

Risk Management

Diversification

Spreading investments across different asset classes, sectors, and geographic regions to reduce overall portfolio risk.

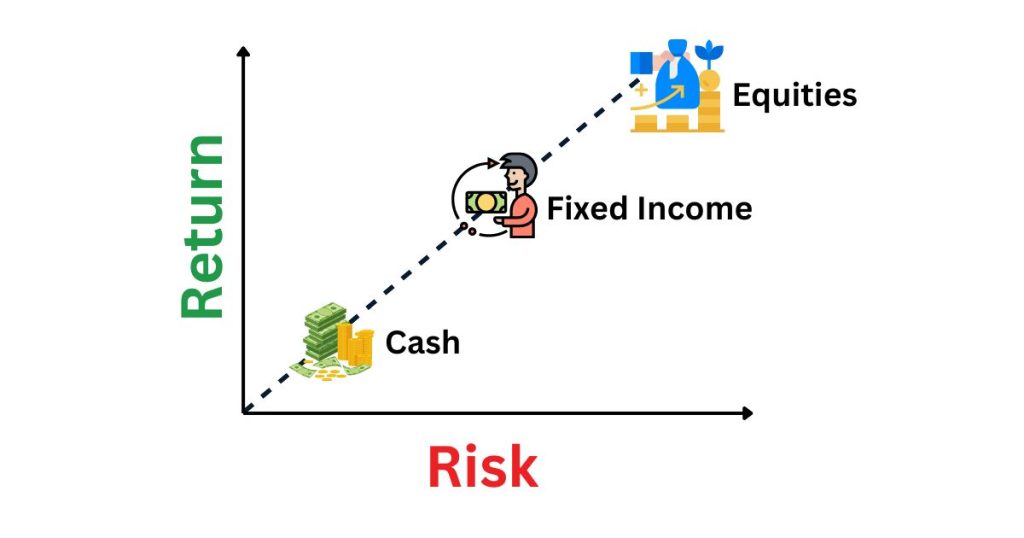

Asset allocation

Determining the right mix of asset classes in a portfolio based on an investor’s goals, risk tolerance, and investment horizon.

Stop-loss orders

Using stop-loss orders to automatically sell a stock if it falls below a certain price, to limit losses.

Position sizing

How much to invest in each position to manage risk and maximize returns?

Advanced tools

Using advanced risk management tools such as:

- Value at Risk (VaR): Calculating the potential loss of a portfolio over a time period

- Monte Carlo simulations: Running multiple scenarios to see potential outcomes and risks

Market Regulation and Oversight in India

Regulators

- Securities and Exchange Board of India (SEBI): The main regulator of India’s stock markets, enforces securities laws and protects investors.

- Reserve Bank of India (RBI): The central bank that regulates foreign exchange and overseas investments.

Key Acts

- SEBI Act, 1992: Created SEBI to protect investors and regulate the market.

- Foreign Exchange Management Act (FEMA), 1999: Regulates foreign exchange and overseas investments.

- Prevention of Money Laundering Act, 2002: Prevents money laundering and confiscates property derived from such activities.

Market Fairness

Insider Trading: SEBI investigates and penalizes insider trading cases under SEBI (Prohibition of Insider Trading) Regulations, 2015.

Market Manipulation: Price rigging or creating artificial market conditions is prohibited under various SEBI regulations.

Global Markets and International Investing from India

Investing in Global Markets from India

Indian investors can invest in global markets through:

- Liberalized Remittance Scheme (LRS): Allows individuals to remit up to $250,000 per financial year for various purposes including overseas investments.

- International Mutual Funds: Indian mutual funds that invest in foreign securities.

- Indian Depository Receipts (IDRs): Foreign companies can list their depository receipts on Indian stock exchanges.

GIFT City and IFSC

The Gujarat International Finance Tec-City (GIFT City) has India’s first International Financial Services Centre (IFSC) which offers various benefits for international investments:

- Tax benefits for entities operating in GIFT City

- Simplified regulatory framework for international financial transactions

- A platform for Indian companies to raise funds from global investors

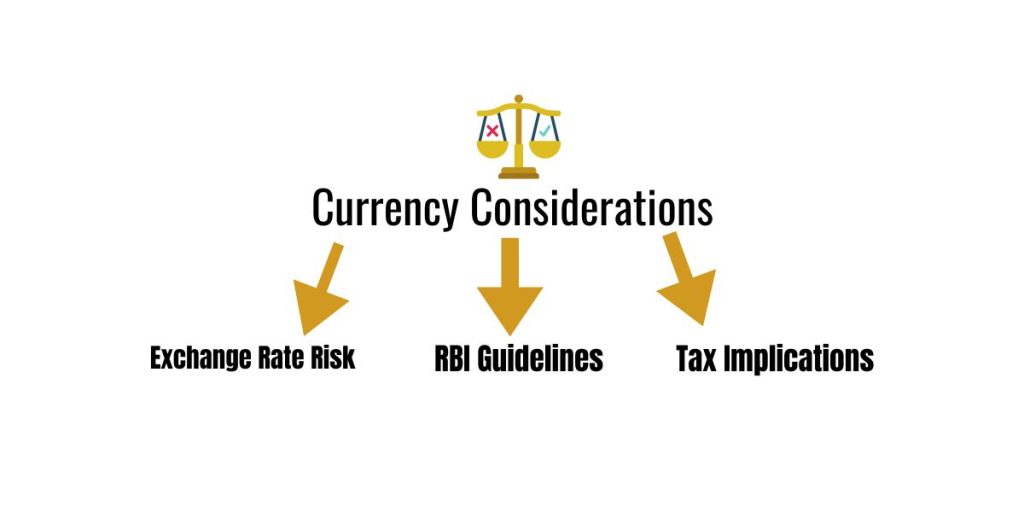

Currency Considerations

When investing globally from India, you need to consider:

- Exchange Rate Risk: INR-USD or other currency pairs can impact your returns.

- RBI Guidelines: Compliance with RBI’s foreign exchange regulations is a must for international investments.

- Tax Implications: Tax treatment of foreign investment income in India.

Alternative investments in India

Real Estate Investment Trusts (REITs)

REITs in India allow investors to participate in the real estate market without directly owning property:

- Introduced in India in 2019

- The minimum investment is often lower than direct real estate

- Provides regular income through rent distributions

Infrastructure Investment Trusts (InvITs)

Similar to REITs, but focused on infrastructure projects:

- Invest in income-generating infrastructure assets

- Aim to provide stable returns to investors

Commodities

Indian investors can participate in commodities markets through:

- Multi Commodity Exchange (MCX)

- National Commodity and Derivatives Exchange (NCDEX)

- Commodity-focused mutual funds and ETFs

Private Equity and Venture Capital

While traditionally limited to high-net-worth individuals, some options are emerging for retail investors:

- Category II Alternative Investment Funds (AIFs)

- Platforms offering fractional ownership in startups

Behavioral Finance in Indian Markets

Common Investor Biases in India

- Home Bias: Preference for domestic stocks over international diversification

- Herd Mentality: Following the crowd in investment decisions, often seen during IPO frenzies

- Recency Bias: Giving more importance to recent market events

- Overconfidence: Overestimating one’s ability to pick winning stocks

Market Psychology in India

Factors influencing Indian market psychology include:

- Cultural attitudes towards risk and wealth

- Impact of religious and astrological beliefs on trading patterns

- Influence of global market trends on local sentiment

Emotional Investing

Common emotional pitfalls for Indian investors:

- Fear of missing out (FOMO) during bull markets

- Panic selling during market downturns

- Attachment to inherited stocks or family businesses

Technology in Indian investing

Online Trading Platforms

Popular online brokers in India include:

- Zerodha

- Upstox

- Angel Broking

- ICICI Direct

Mobile Trading Apps

Features of popular Indian trading apps:

- Real-time market data

- Paperless account opening

- Integration with UPI for quick fund transfers

- Educational resources and market news

Robo-Advisors in India

Emerging robo-advisory services offer:

- Automated portfolio management

- Goal-based investing options

- Lower minimum investment requirements

Algorithmic Trading

While primarily used by institutional investors, retail access is growing:

- SEBI regulations on algorithmic trading

- Platforms offering algo-trading capabilities to retail investors

- Importance of understanding risks and regulations

Sustainable and Responsible Investing in India

Environmental, Social, and Governance (ESG) Factors

ESG is catching up in India:

- Companies with good environmental practices

- Social responsibility and ethical governance

- SEBI’s guidelines on Business Responsibility and Sustainability Reporting (BRSR)

ESG Funds in India

Several MFs and ETFs are ESG-focused:

- SBI Magnum Equity ESG Fund

- Axis ESG Equity Fund

- Quantum India ESG Equity Fund

Impact Investing

Many opportunities to invest in social and environmental causes

- Microfinance institutions

- Social venture funds

- Green bonds for renewable energy projects

Challenges and Opportunities

- No standard ESG reporting in India

- Younger investors are becoming aware

- Long-term value creation through sustainability

Tax for Indian Investors

Capital Gains Tax

- Short-term Capital Gains (STCG): Equity held for less than 1 year, 15%

- Long-term Capital Gains (LTCG): Equity held for more than 1 year, 10% above ₹1 lakh

Dividend Taxation

Changes in dividend tax policy:

- Dividends are now taxed in the hands of the investor

- DDT abolished for companies

Tax Saving Options

- Equity-Linked Savings Scheme (ELSS) mutual funds

- National Pension System (NPS)

- Unit Linked Insurance Plans (ULIPs)

Tax Implications of International Investing

- Double Taxation Avoidance Agreements (DTAA) with various countries

- Foreign Tax Credit (FTC) for taxes paid overseas

- Reporting requirements for foreign assets in ITR forms

Economic Indicators and Market Impact in India

Economic Indicators

- Gross Domestic Product (GDP): Overall economic output and growth rate

- Index of Industrial Production (IIP): Industrial sector performance

- Consumer Price Index (CPI): Retail inflation

- Wholesale Price Index (WPI): Wholesale inflation

- Purchasing Managers’ Index (PMI): Manufacturing sector health

Monetary Policy Indicators

- Repo Rate: RBI’s lending rate to banks

- Reverse Repo Rate: RBI’s borrowing rate from banks

- Cash Reserve Ratio (CRR): Percentage of deposits banks must park with RBI

- Statutory Liquidity Ratio (SLR): Minimum percentage of deposits banks must hold in liquid assets

External Sector Indicators

- Current Account Deficit (CAD): Difference between imports and exports of goods and services

- Foreign Direct Investment (FDI): Foreign investment in Indian companies

- Foreign Institutional Investment (FII): Foreign investment in Indian securities

- Exchange Rate: Indian Rupee against major currencies, especially USD

Market Impact

- GDP Growth: Higher growth is generally good for the market

- Inflation: High inflation may lead to tighter policy which can impact stock prices

- Interest Rates: Lower rates are good for the market as borrowing becomes cheaper

- FII Flows: Big impact on market liquidity and stock prices

- Rupee Value: Depreciation is good for export-oriented sectors but bad for import-dependent sectors

Risk Management for Indian Investors

Types of Risks in Indian Markets

- Market Risk: Overall market movement impacting stock prices

- Company-specific Risk: Risks associated with individual companies

- Liquidity Risk: Difficulty in buying or selling stocks

- Currency Risk: For investments in foreign securities or export-oriented companies

- Political and Regulatory Risk: Government policies and regulations

Risk Management Strategies

- Diversification: Spread investments across sectors and asset classes

- Asset Allocation: Balance portfolio between equity, debt, and other assets based on risk appetite

- Stop-loss Orders: Set predetermined exit points to limit losses

- Hedging: Use derivatives like futures and options to protect against losses

- Regular Portfolio Review: Periodic review and rebalancing of investments

Risk Assessment Tools

- Beta: A measure of a stock’s volatility against the market

- Standard Deviation: Volatility of returns

- Value at Risk (VaR): Potential loss in value of a portfolio

- Sharpe Ratio: Risk-adjusted return

Why Risk Management

Effective risk management helps you:

- Preserve capital in market downturns

- Achieve long-term goals

- Make informed decisions

- Stay disciplined in volatile markets

Continuous Learning and Resources for Indian Investors

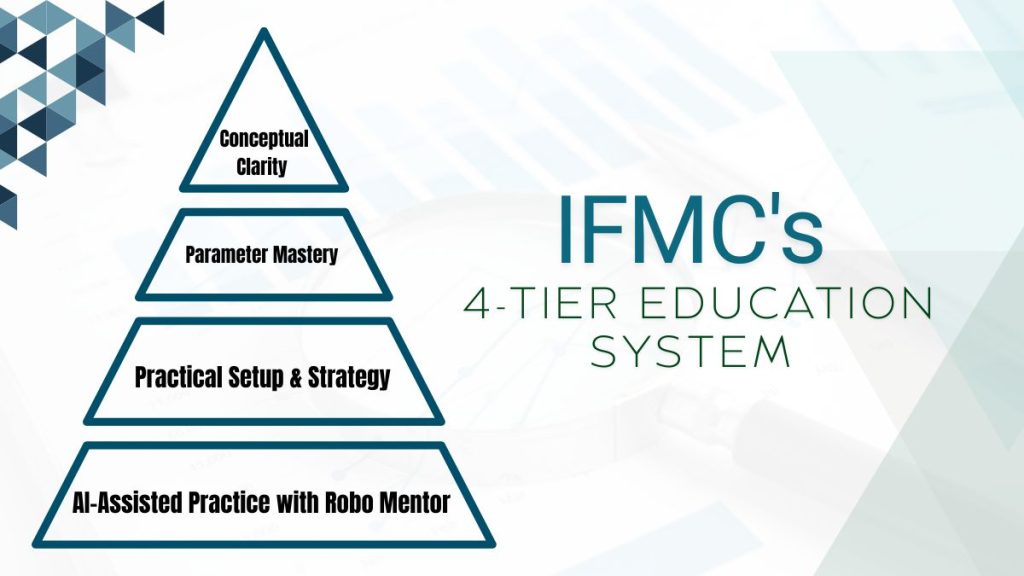

Online Learning Platforms

- IFMC’s, NISM-based e-Learning: Various financial market courses

- BSE Institute: IFMC offers BSE Certification programs and workshops

- IFMC’s NSE Academy based Stock markets, derivatives, and financial planning courses

Books and Publications

- UDTS© – Intraday Trading Brahmastra by Manish Taneja

- “The Intelligent Investor” by Benjamin Graham

- “One Up On Wall Street” by Peter Lynch

- “Bulls, Bears and Other Beasts” by Santosh Nair (Indian context)

- “Stocks to Riches” by Parag Parikh

- Company annual reports

- SEBI Bulletins and RBI publications

Financial News and Analysis

- Financial newspapers: Economic Times, Business Standard, Mint

- TV channels: CNBC-TV18, ET Now, Bloomberg Quint

- Websites: Money Control, Value Research Online, Screener

Investor Education Initiatives

- SEBI’s Investor Education Programs

- NSE’s Investor Education Portal

- BSE Investor Protection Fund initiatives (BSEIPF)

- Financial Planning Standards Board India (FPSB) resources

Additionally, various organizations offer free stock market courses aimed at educating individuals about trading and investing, with lifetime access to foster a knowledgeable community of traders.

Networking and Forums

- Local investor clubs and meetups

- Online forums: Value Investing Club, IndianStreetBets (Reddit)

- Social media groups focused on Indian stock markets

Regulatory Framework and Investor Protection in India

Key Regulatory Bodies

- Securities and Exchange Board of India (SEBI): The primary regulator for securities markets

- Reserve Bank of India (RBI): Regulator for banking and monetary policy

- Insurance Regulatory and Development Authority of India (IRDAI): Regulator for insurance sector

- Pension Fund Regulatory and Development Authority (PFRDA): Regulator for pension funds

Rules

- SEBI (LODR) Regulations

- SEBI (IT) Regulations

- SEBI (SAST) Regulations

- SEBI (MF) Regulations

Investor Protection

- Investor grievance mechanism

- SEBI Complaints Redress System (SCORES)

- Stock Exchange Investor Protection Funds

- Arbitration for disputes with brokers

Know Your Rights as an Investor

- Right to know about investment products

- Right to fair and transparent pricing

- Right to complaint redressal

- Right to financial education

Investor Safety

- Deal only with SEBI-registered intermediaries

- Keep records of all investment transactions

- Monitor your demat and trading account regularly

- Be cautious of unsolicited investment advice

- Know the risk-return of investments

FAQs

How to start investing?

To start investing in stocks follow these steps:

- Educate yourself about the stock market and investing basics

- Define your investment goals and risk tolerance

- Choose a reliable online broker or investment platform

- Open and fund your investment account

- Start with a diversified portfolio of stocks or index funds

- Monitor and rebalance your portfolio regularly

Joining a community of stock market traders can provide valuable insights, support, and resources for individuals looking to enhance their trading skills.

What are the risks of stock investing?

Stock investing has the following risks:

- Liquidity risk: Some stocks are hard to sell fast

- Market risk: The market may go down

- Company risk: Companies may underperform or go bust

- Volatility: Stock prices can move big time in the short term

- Economic risk: Economic downturn will affect stock performance

What is the difference between fundamental and technical analysis?

Fundamental analysis focuses on a company’s financial health, industry position, and economic factors to determine its intrinsic value. Technical analysis, on the other hand, studies price patterns and trends using charts and statistical indicators to predict future price movements. Know more about fundamental and technical analysis.

How do I read a stock chart?

To read a stock chart:

- Identify the time frame (e.g., daily, weekly)

- Look at the price axis (usually on the right)

- Observe the volume bars at the bottom

- Note any moving averages or other indicators

- Look for patterns in price movements

- Consider how news events align with price changes

What is the importance of diversification in investing?

Diversification is key because it:

- Smooths out market volatility

- Reduces overall portfolio risk

- Protects against big losses in any one investment

- Can improve long-term returns