Everyone admires to invest in share market or stock market. But the majority of us do not know the share market basics. Understanding stock market basics is crucial for navigating the complexities of stock trading. We will answer all your questions in this post.

Do you want to learn more than buy and sell in share market? And would you like to earn higher profits like professional at a Wall Street? Instead of learning advance share market concepts, make your core strong.

Stock Market Origin

How Company Source Capital?

A company will surely reach the bank to raise funds. There are only 50% chances that the bank will approve a loan to a start-up. Adding more cons to this situation, the bank charges a huge amount of interest on this capital.

So, planning to get a loan from a bank has its own disadvantage of paying the debt. Under this possibility, getting a loan from a bank to operate a business is not an eligible idea for most investors. Companies can also utilize the stock market to raise capital by selling shares, allowing them to access funds while providing investors with opportunities for returns through capital gains and dividends.

Finding an Investor

How does a company finds investors? An alternative option is to find an investor who can offer capital in the company. Finding investors takes a quality idea and pitch to find success. The advantage of source funds from investors is not to repay a loan.

An investor is a person or an entity who keeps a portion of a profit from the business. They commit capital with the expectation to receive nominal financial returns. Mutual funds allow investors to pool their money together to invest in companies, providing professional fund managers with a way to achieve a diversified portfolio and potentially benefit from returns through unit values or dividends.

Private Investment Channels

As a business grows, they require more capital to increase sales and profits. Here come venture capital and angel funding. They are a form of private equity that offers investment in startup companies or small business that believe to have long-term growth.

A venture capital company invests in a business in exchange for equity or ownership stake in the company. Now, business needs more capital to expand. The above two sources of funding – bank and venture capital have their own limitations. The next approach to generate investment from the public.

Share market is an insanely useful way to source capital from the public. A small business owner may consider expanding the business from share to market capitalisation. What is the share market? A share market is a place where the general public (investors) invests in a company to generate profits. A share market is similar to the stock market.

The key difference is that a stock market allows the trade of securities like bonds, futures, options, derivatives, and other commodities. Share market allows to own portfolios trade shares only.

Also read about Future and Option Trading

Investors get a part of the ownership of a company by buying a share of the company. Investors benefit from stock by investing in stocks and by making profits from the business. Thus, investors refer to a company’s ‘shareholder’.

The investment decisions are influenced upon company past, present, and future growth. A company offers public shares of a company is a form of prospects which is known as IPO. IPO stands for Initial Public Offering. It is a process of offering shares of a private organization to the public in a new stock issuance.

Learn More:Career in Stock Market

The share market is primarily divided into bear markets such as the primary market and the secondary market. A primary market is a place where the company registers to issue a certain amount of shares to raise money.

The secondary market is the place where investors buy and sell securities they already own. Typically, an investor calls out a transaction using an intermediate such as a broker to facilitate the process. For serious investors, having a diversified portfolio, which can include mutual funds or exchange traded funds (ETFs), is more advantageous than attempting to pick individual stocks.

Stock Exchange

A stock market course for beginners can be overwhelmed with the stock exchange. A stock exchange or securities exchange is a place where stock brokers and traders buy and sell securities. For instance, shares, currency, gold, crude oil, commodity.

Once the investors make an investment in a company’s assets, business spends the money in the market. Here comes the role of the stock exchange. The stock exchange like National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) regulate and monitor the share market activity. The New York Stock Exchange (NYSE) is also a major stock exchange that plays a significant role in the global financial market. An investor sells shares in the stock exchange.

Stock exchange facilitates the issue and redemption of securities. Initial public offerings of stocks is done in the primary market. Subsequently, publicly traded companies are in the secondary market. A stock exchange is the most important aspect of a share market. Surprisingly, supply and demand in the stock market are driven by several factors.

Let’s start with the Share bazaar basics

Now, that we’re done with the stock market terminology, it’s time to move on to frequently asked questions on stock or share bazaar basics.

Understanding Stock Market Basics

If you ask layman about how stock market investing, they will tell you they do not know. When the stock market is the biggest earning revenue stream in the world. As many stock market investors have made billions of dollars just by investing a few penny. Let’s stitch the above terminologies to understand how to invest in the stock market!

An investor can enter stock market through a trader or a stockbroker. A Demat account is a secure and convenient way to keep track of your investment in a securities and exchange board. It is an electronic platform where shares are kept safely. While a trading account is a type of a brokerage account represent investors to buy and sell stocks. Executing stock trades through brokers is essential for making transactions, and understanding stock trading principles is crucial for effective investment.

Opening a Demat or trading account is a simple step. You can create a Demat account online in a few clicks. You may need to wait for a few weeks for approval. During the approval process, they will verify the documents.

Check: Learn Stock Trading Online India

How to Buy Shares?

Now you have a Demat account. The next process is to buy a share. Buying a share involves the following process:

- Open Demat Account

- Add fund in the Demat account through a bank.

- Place order in the stock exchange

- A broker sends it to exchange

- Exchange finds out counterparty

- Exchange confirms to your broker

- Broker or trader debit/credit to your account

Stock prices are influenced by supply and demand in the market, where high demand can drive prices up and increased supply selling stocks can push prices down.

Indian Stock Exchange

Most of the share trading in India Stock Exchange takes place in its two stock exchanges – NSE and BSE. National Stock Exchange or NSE is a leading stock exchange of India. Its headquarters is in Mumbai. There are 1,952 (2019) companies listed in NSE.

Bombay Stock Exchange (BSE) is Asia’s first and the world’s 10th largest stock exchange. There are 5,439 (2019) companies listed on BSE. Stock markets play a crucial role in financial markets and economies by providing platforms for buying and selling shares, which impacts both individual investors and broader economic conditions.

Popular terms in Stock Markets

There are several confusing stock market terms beginners should know. Here are a few popular terms:

- SENSEX is a benchmark index of the Bombay Stock Exchange

- NIFTY is a benchmark index of the National Stock Exchange

- Bull Market is a condition of a financial market in which prices rise or expected to rise.

- Bearish Market is a condition when securities fall 20% or more

- Stock price is driven by expectations of corporate earnings or profits.

- Stock volatility is a degree of variation in trading price. The stock price constantly fluctuates because of increasing and decreasing demand for shares.

Traders actively engage in trading stocks and other financial instruments to take advantage of market volatility over shorter time frames, focusing on technical analysis and quick buying and selling to achieve fast profits, contrasting with investors who typically adopt a long-term strategy for growth.

How to Earn from the Stock Market?

We have covered the basics of the stock market index. The last questions are how to earn from stock market? There are two approaches to earn from share market.

- Investors buy shares for investment at a low price and sell at a higher price. This process is known as capital appreciation. Capital appreciation is a rise in the value of the security. Investors hunt for a stock which has future stock price value have a maximum probability to increase.

- Capital dividend is a payment that a company makes to its investors that is drawn from a company paid-in-capital. Investors buy shares of a company assuming to get higher dividend.

The stock market works as a marketplace where investors buy and sell shares of companies, allowing them to profit from rising stock prices and price fluctuations.

When to Sell Shares?

There is only one reason to sell your shares. Making money in the stock market depends on the time you buy or sell a stock. Many of us find it difficult to decide when to sell a stock. This has rooted in the innate human tendency toward greed. Understanding stock market basics is crucial before making any investment decisions.

The right time to sell your share is when the share price value is expected to fall. This is the situation when the stock price drops and the profit of the company decreases. The process of a decision depends on several technical and fundamental analyses. Stock market analysis gives you insight into analyzing stock market data for the purpose of investment.

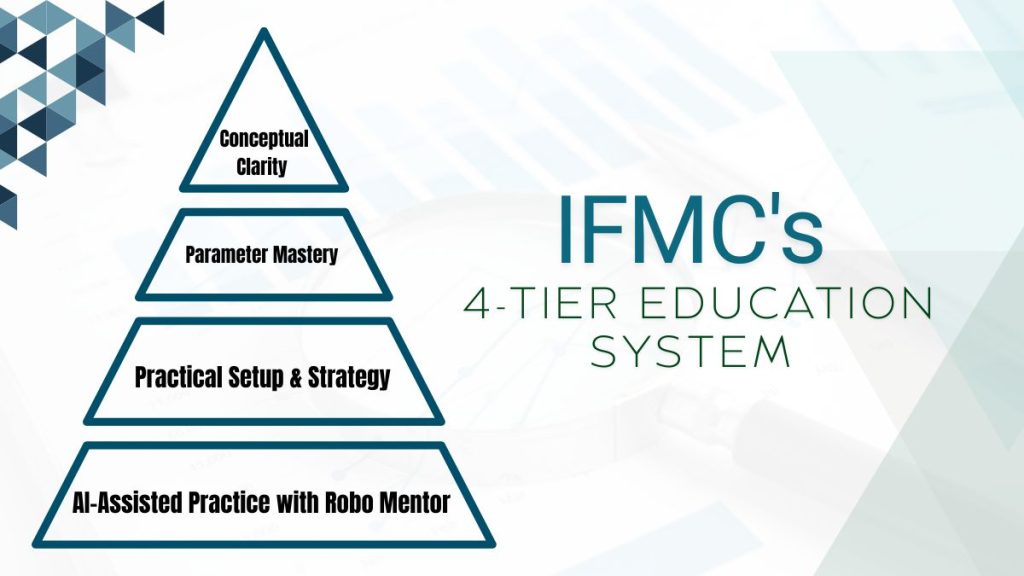

You can learn stock market analysis from IFMC. Join our online stock market courses. After completing the course, you’ll become independent and self-traders in only a few classes. There are multiple types of market and each one of them has their own policy. A smart investor makes a comprehensive stock market work and study to make a profitable trade.

Also, read about the Options Trading Guide