The Mastermind Behind UDTS© & MADE© Copyright Trading Strategies

Manish Taneja, a Senior Research Analyst at IFMC® Educational Institution Pvt. Ltd., is renowned for his simple yet effective teaching methodologies at IFMC Institute and IFMC®’s YouTube Channel. His copyright stock trading strategies and experience span over three decades, inspiring millions of global traders. His unique copyright stock trading strategies, Uni-Directional Trade Strategies© (UDTS©) & MADE©-Market Analysis by Data & Events, has garnered over 13 million views on YouTube and is favored in more than 171 countries.

Manish Taneja’s pedagogic style instills precision and self-assurance in his pupils. His humility and grounded nature have earned him admiration among both students and peers. He advocates continuous learning and resilience, traits that set him apart in the industry. His journey from Ring Trading to Online Trading has honed him into an experienced trader and mentor. Manish Taneja is driven by his mission to democratize trading, making it possible for anyone to gain from the stock market, irrespective of their background or expertise. Explore 8 stock trading courses by IFMC

The Copyrighted Content:

UDTS© Trading strategies can be copyrighted provided they are original and meet the criteria for copyright protection. UDTS© & MADE© copyright trading strategies by the IFMC institute are exclusive content. While there are numerous strategies available, they cannot be copyrighted as they are amalgamations of existing chart patterns and technical analysis tools.

UDTS© strategies have redefined trend analysis, distinguishing them from others. They interpret the language of charts uniquely and incorporate market behavior, elevating them above all other trading strategies globally. Copyright law safeguards the expression of ideas, not the ideas themselves.

Therefore, if a trading strategy is sufficiently novel and is expressed in a tangible form (like a written document or code), it could qualify for copyright protection. However, the protection does not cover the underlying facts or methods in the strategy, only the specific representation of those ideas. Manish Taneja’s book, UDTS© Intraday Trading Brahmastra, has also been copyrighted.

Is Technical analysis sufficient to become an Ace Trader?

Technical Analysis encompasses numerous chart patterns and indicators employed by different analysts, each with their unique approach to analysis. However, no single tool of technical analysis can consistently deliver the desired results without an accompanying confirmation strategy.

IFMC’s UDTS© strategy is a unique strategy that accurately indicates entry (demand) and exit (supply) points when combined with modern tools and chart patterns of Technical Analysis. It’s a precise strategy enabling traders to accurately identify support, resistance, target, and stop loss just by comprehending the language of charts.

Individually used technical tools may not always yield perfect results, but when used in conjunction with a robust STRATEGY and a well-defined TRADE MODEL, they can significantly benefit stock traders. Without a solid and reliable track, the tools of technical analysis cannot be used optimally. In simple terms, if technical analysis is the train, then UDTS© is the track.

Consider this analogy – Ramayana was originally penned by Valmiki ji and later adapted by Tulsidas ji. The adaptation was well-received because people during that time were familiar with Sanskrit and Maithili. However, our ancestors simplified it further by encouraging children to stage Ram Lila in local dialects for easier understanding.

Similarly, understanding technical analysis becomes simpler when combined with the UDTS© strategy. When a trader merges UDTS© STRATEGY+TECHNICAL ANALYSIS+ UDTS© TRADE MODEL, they achieve the desired outcomes from their stock trading.

The formula to become an ACE TRADER = ACE STRATEGY + TECHNICAL ANALYSIS+ PERFECT TRADE MODEL

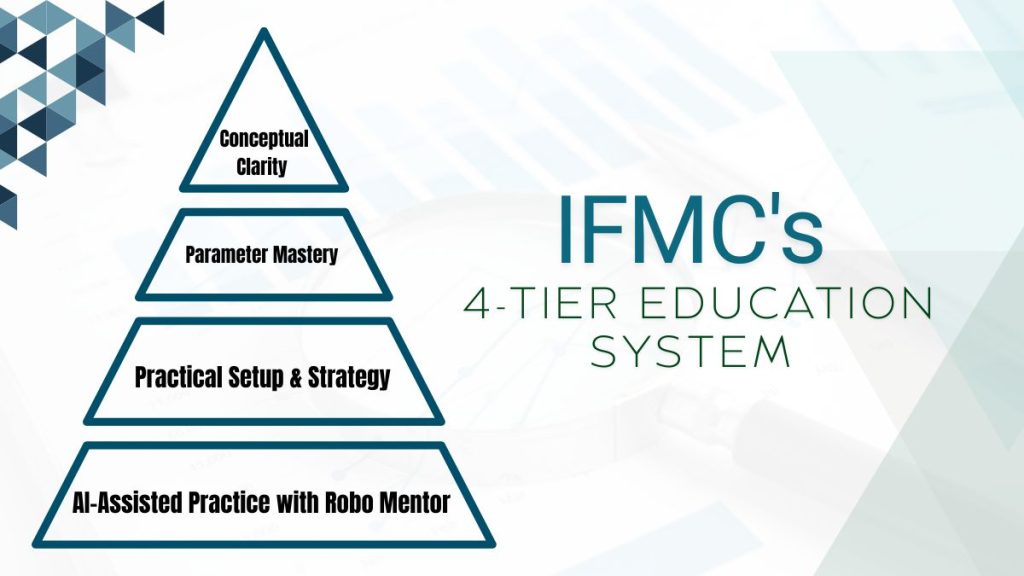

IFMC institute has pioneered a specially designed Technical Analysis course that combines its UDTS© strategy and a UDTS© trade model, enabling anyone to become a proficient trader. This makes IFMC a leader in stock market courses.

UDTS©, or Uni-Directional Trade Strategies©, is an ideal share market trading strategy for beginners, investors, and traders. It is designed for those who wish to learn various trading forms – intraday, short-positional, positional, long-positional, and wealth creation trading, aiming to become expert traders.

UDTS TRADING STRATEGIES©

UDTS© is a game-changer in stock market trading. This revolutionary strategy, launched in April 2018, has caught the attention of traders and industry players worldwide. Based on basic tools of Line Charts and Candle Charts, UDTS© offers simplified strategies for both Intraday and Positional Trading, making it extremely accessible for beginners and experienced traders alike.

The Popularity and Simplicity of UDTS©

Out of all the copyrighted strategies developed, UDTS© stands out for its simplicity and effectiveness. It doesn’t require complex technical analysis tools, making it the go-to strategy for common traders. It offers a high probability of winning and an excellent risk-reward ratio.

Learning with UDTS©

UDTS© trading strategies teach when to buy, what to buy, and when to sell in the simplest manner possible using trend analysis. It provides an understanding of demand and supply from basic to advanced levels.

UDTS© Bunch of 9 Wonderful Trading Strategies

This popular online course offered by IFMC® shares 9 wonderful trading strategies based solely on candlestick & and line chart patterns, making it easy for beginners to grasp.

Key Features of UDTS© Strategy:

Universal Application

UDTS© strategies apply across all segments of the capital market, futures markets, commodity markets, and currency markets.

Confidence and Accuracy in Trading

UDTS© is the only trading strategy that helps traders trade confidently and accurately. After learning UDTS©, identifying trends and entry-exit points for trades becomes easy.

High Success Ratio with UDTS©

UDTS© delivers a basic understanding of demand and supply, helping to catch the right trend and increasing the probability of winning.

Emotionless Trading with UDTS©

UDTS© offers a mechanism for emotionless trading with fixed parameters. After practicing UDTS© strategies, you can make your intraday trading calls or tips.

Monetizing Market Behaviour with UDTS©

UDTS© has monetized the common market behavior – “Stock Market Moves in a Trend”. This strategy takes advantage of market behavior to get precise results.

Multi-Frame Time Interval for Intraday Trading

UDTS© Intraday Trading Strategy is based on a Multi-Frame Time Interval, increasing the accuracy and success rate of intraday trading.

Monetizing NIFTY and Sensex Trend

UDTS© advocates understanding the trend of the index during intraday trading as it can influence the price of a particular stock.

Basket Trading and UDTS©

Basket trading is a key principle advocated by UDTS©. This approach encourages traders not to put all their eggs in one basket, i.e., not to trade in a single stock. Professional traders understand that they are not gambling, and diversifying their trades across various stocks can significantly increase their winning probability.

Sectoral Analysis with UDTS©

Another essential aspect of the UDTS© strategy is sectoral analysis. Traders are encouraged to buy stocks from sectors currently in high demand and sell stocks from sectors in high supply. This principle is further elaborated in the UDTS© TRADE MODEL.

The Accuracy of UDTS© Strategy

The phrase “Trust, But Verify” was famously used by Ronald Reagan, the 40th President of the United States, and it holds for the world of trading. In an environment ripe with potential for fraud and deception, it’s crucial to constantly verify the information you receive.

Avoiding False Promises in Trading

Many traders are lured by offers like zero-commission brokers or free-to-use tools. However, making money in the stock market is complex and requires careful planning and verification at each step. It’s vital to do your research and not get swayed by advertisements.

Starting Small and Smart with Trading

For beginners, it is advisable to start trading with a small amount of money or to begin paper trading to verify the profitability of any strategy.

Paper Trading: The Trial Run

After understanding the strategy, it’s recommended to start with paper trading. This involves simulating trades in the live market without investing any actual money. It’s an effective way to test the strategy and determine its effectiveness before risking any capital.

Long-Term Success with UDTS©

UDTS© is a powerful strategy that can lead to significant profits in the long run. However, it’s important to remember that not every trade will be successful. There will be times when you lose money, but sticking with the strategy and continuing to make baskets of trades will eventually lead to success.

MADE© – MARKET ANALYSIS BY DATA & EVENT

MADE©, another copyrighted trading strategy by IFMC, is a News and event-based Stock Trading strategy. By accurately analyzing news, data, and events, one can forecast the next moves in the stock market. This strategy operates on the same principle as UDTS, where all technical aspects should align in one direction.

Similarly, in the MADE© model, all NEWS, DATA, and EVENTS should benefit in the same direction. Those who find fundamental analysis too complex to understand will be able to analyze NEWS, DATA, and the market with ease.

Adding another feather to IFMC’s cap after UDTS is MADE©. It’s intriguing how your views can become the next day’s news headlines. In the years 2018-19, IFMC launched its innovative strategy UDTS, which revolutionized the stock market. UDTS simplified stock market trading for the common man, enabling accurate trades without the need for complex technical analysis tools.

UDTS earned IFMC global recognition and laurels, establishing IFMC’s unique identity and making it a front-runner and the best institute for STOCK MARKET COURSES.

UDTS also brought awards to IFMC, earning it the title of “EXCELLENCE IN FINANCIAL MARKET COURSES.” IFMC unquestionably became the top institute in Stock market courses catering to students, investors, traders, housewives, etc. Traders and investors worldwide were curious about “How to make UDTS more precise.”

The IFMC Research Team worked tirelessly and concluded that predicting the DIRECTION OF MARKET along with the DIRECTION OF STOCK could improve a trader’s winning probabilities. Upholding the philosophy of simplicity and innovation, IFMC has introduced a new course, MADE© – “MARKET ANALYSIS BY DATA AND EVENT.”

What is MADE©?

MADE©, which stands for “MARKET ANALYSIS BY DATA AND EVENT”, is another groundbreaking model from IFMC. Following UDTS, MADE© is set to create ripples in the stock market.

The MADE© model of IFMC is another innovation by our Senior Researcher, Mr. Manish Taneja. MADE© has simplified the process of learning the market’s language and analyzing it. MADE© is a news-based stock trading strategy that empowers traders to make informed decisions by properly analyzing news and events.

MADE© represents the next level of simplicity in stock market trading. Those who have already purchased UDTS can upgrade to MADE©.

Understanding the driving forces behind the stock market is crucial in MADE© – “MARKET ANALYSIS BY DATA AND EVENT”. The stock market doesn’t function in isolation. It is influenced by numerous driving forces, both international and domestic, that cause bullish or bearish market movements. Grasping these driving forces will make predicting the market much simpler.

To comprehend these driving forces, we must decode the market’s language. The market provides numerous clues, but we can only understand them if we know its language.

So, what is the market’s language?

MADE© teaches you to decipher the market’s language. Once you understand this language, it becomes much easier to comprehend the market and act accordingly. You will learn how to interpret what news and numbers are telling us. You will understand the impact of various events on the market and how it responds to uncertainties that drive the NIFTY or Sensex up or down. This news-based stock trading strategy will also clarify the reasons for gap-up or gap-down openings.

DAVID BUCKINGHAM – Ref quote

Data is the new OIL, We need to

FIND IT

EXTRACT IT

REFINE IT

and MONETISE IT

DATA—-KNOWLEDGE—-ACTION —-MONEY

Let’s Learn the language of the market through IFMC’s Innovative course

MADE© – “MARKET ANALYSIS BY DATA AND EVENT”.

This copyrighted content from IFMC helps you unravel the market’s language and predict market trends based on News Analysis.

Trading in the market depends on two parameters: technical aspects and fundamental aspects. In MADE©, we simplify the study of the fundamental aspect of trading.

Understanding How MADE© Operates The MADE© model operates on the same principle as UDTS. Just as all technical aspects should align in one direction in UDTS, all DATA and EVENTS in the MADE© model should benefit in the same direction.

For those who find fundamental analysis too complex, MADE© will simplify your understanding of DATA and the market. Like all other lectures by Mr. Manish Taneja, MADE© is another gem in IFMC’s crown following UDTS.

Course Outcomes of MADE©

You’ll be able to interpret data and relate results and news to the market. A successful trader can link data to the country, sector, and industry, and then to the stock.

After mastering MADE©, you’ll be able to understand the overall market feature, relate Data and news with the market, and comprehend their impact on the market. Upon completing MADE©, YOU WILL BE ABLE TO PREDICT THE DIRECTION OF THE MARKET.

How Does It Work?

Just like our UDTS Model, we use the same principle for MADE©. In UDTS, all directions or trends should be in one direction. Similarly, to understand MADE©, all News/Events/Data should benefit in the same direction for:

- Country

- Sector

- Industry

- Stock’s Own Fundamentals

- Technical Outlook with UDTS

This will be taught in a simplified manner in our ONLINE CLASS OF MADE©.

MADE© – The Optimal Copyright Strategy

MADE© is the optimal copyright strategy for those seeking to make more precise predictions of the market and stocks simultaneously. It provides a more accurate market forecast through news analysis and data analysis. Both News Analysis Data Analysis, and Event Analysis, are part of Fundamental analysis.

Knowing where the Stock Market is going and predicting the stock market direction is most desirable by any professional trader to win in the stock market and be profitable in stock market trading MADE© gives the best market outlook to trade confidently and to predict the market successfully.

Whether you’re trading in the capital market, derivative markets, MCX trading, commodities, currency, forex, Crude, or Gold trading, being knowledgeable is essential.

Terms like inflation, GDP, Rate cut, CPI numbers, OPEC announcements, and oil inventory can be challenging to understand.

Learn about the Indian economy, its direction, Data-based trading, news-based trading, and how to interpret Data to become an “Xpert Trader” with copyright trading strategies.