You have probably heard about investing in the share market for long-term profits. It becomes challenging for an individual to sustain with the rising inflation and increasing price. It has always been important to invest (save money) as an alternate source of income for a comfortable lifestyle and secure financial future. Investing in the stock market enables you with lucrative returns.

As stock market investment is risky in nature and can turn out to be profitable only when the decision of investment is made with due diligence. If you are the stock market beginner, it is crucial to understand the fundamental, types of stock, and do’s and don’ts on investing in the market. If you don’t know how to invest in the share market, don’t worry, we got you covered.

Table of Contents

ToggleHow to learn share trading?

Institute of Financial Market Courses (IFMC) offers an offline and best online course for share market beginners. The courses offered by the IFMC are designed for stock market traders, freshers, and investors. The Unidirectional Trade Strategies course (UDTS) is a copyright course by IFMC This course will allow you to learn to share trading important trade strategies.

What is a share?

A share is a form of security that represents a corporation owned and depicts the claim on particular corporation assets and earnings. Shares are often referred to as equities as they are characterized as business ownership or equity. A share market is similar to stock market whereas the only difference is that share market allows trading of shares while the stock market helps you in financial trading of securities like mutual funds, bonds, derivatives, etc.

What are the different types of shares?

The two types of shares are:

- Common shares: Common shares or common stock represents a part of company ownership entitled to their profit and loss. In these cases, shareholders reserve a right to elect a company’s Board of Directors.

- Preferred shares: A preferred share is a type of securities where the shareholder gets a specific dividend at a predetermined interval. The dividend paid to the shareholders of the preferred stock is typically more than the dividend paid to the common stock shareholders.

Beginner’s guide to investment in the stock market:

The following is a list of do’s and don’ts that help you in investing with stock market trading for beginners.

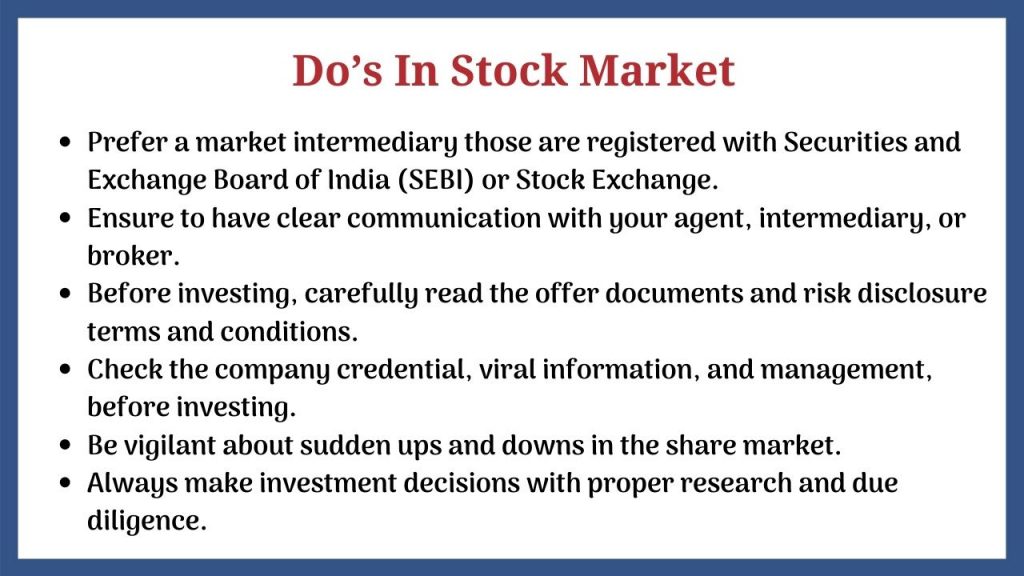

Do’s in stock market

- Prefer a market intermediary those are registered with Securities and Exchange Board of India (SEBI) or Stock Exchange.

- Ensure to have clear communication with your agent, intermediary, or broker.

- Before investing, carefully read the offer documents and risk disclosure terms and conditions.

- Check the company credential, viral information, and management, before investing.

- Be vigilant about sudden ups and downs in the share market.

- Always make investment decisions with proper research and due diligence.

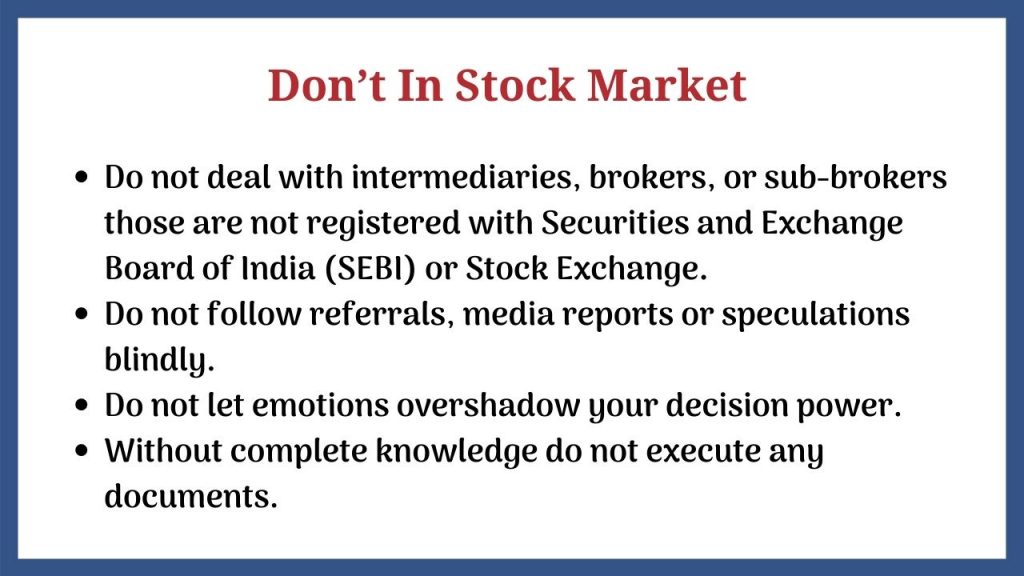

Don’t in stock market

- Do not deal with intermediaries, brokers, or sub-brokers those are not registered with Securities and Exchange Board of India (SEBI) or Stock Exchange.

- Do not follow referrals, media reports or speculations blindly.

- Do not let emotions overshadow your decision power.

- Without complete knowledge do not execute any documents.

Check: What is Financial Modelling?