If you are searching for quick tips to prepare for next week’s stock market levels, profitable trades outlook and smart technique to take the market position, then this post is definitely is the right place to begin.

Stock market weekly preview is a guide for investors and traders to help you prepare in advance for share market investing for the upcoming week.

Last Week Stock Market Preview

NIFTY50 on Friday 27 September 2019 closed at a level of 11,512. Last week, there is no major fluctuation in the market numbers. Overall, the market closed at 30 points down, while the undertone is a constant bullish market. In the last post, Mr. Manish Taneja (Sr. Research Analyst) in stock market weekly updates series predicted that stock market last week sentiments –

- Bullish on long positional trades

- Bullish positional trades

NIFTY50 level predicts to stay between the range of 10,700 to 11,700. Check out our last post on stock market 22-28 September 2019.

Overview of Stock Market Last Week on Candlestick Chart

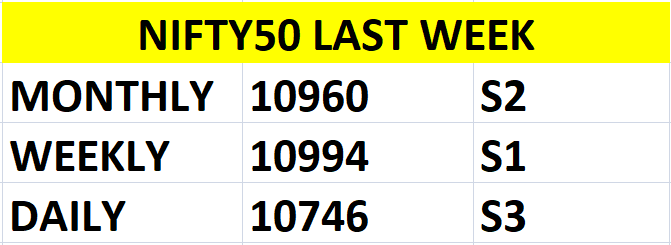

Last week the support level 1 was 10,740, support level 2 of 10,960, and support level 3 of 10,995. These were the three support levels on a monthly, weekly, and daily charts. We predicted a market-level range of 10,700 to 11,700.

Last week, the Finance Minister announced a booster Dose for the economy. The efforts resulted in the biggest pullback rally. Where the market on Friday 20 September 2019, NIFTY 50 closed at an increased level of 525 points.

On Monday 23 September 2019, NIFTY50 opened with an upward gap of almost 300 points and stayed within a narrow range for a full week. There was no major fluctuation in the market. On Wednesday the market dropped down at a slow pace where on Friday the market level rise.

The market did not cross the predicted level of 11,700. The predicted market levels were analysed using Unidirectional Trade Strategies. UDTS is a simple mechanics to predict market levels using technical indicators for intraday trading.

Due to constitute good market news, the economy is trying to stabilize. Note that the level change due to market performance. Now, it’s time to see how the market reacts to the economy sentiment booster. For the upcoming week, the market may slow down depending on good or bad news. Overall market is in upward momentum so first Buy then sell is advised. Avoid short positions. Positions of buying or selling should be made only after analysing the market levels.

Now, let’s study the news and events from last week will affect the market levels for the upcoming week.

Domestic Positive Market News

- Positive sentiments on the big economic booster. The market last week opened at a piece of positive news. While the positive impact is here to see for the upcoming week as well.

- Demand to rise in festive seasons. Finance Minister said last week, the festive seasons is here to come, where private consumer consumption level is expected to increase, thereby, demand and supply levels will increase. As an impact, a major increase in market level will be seen.

- Economy to be back on track in six months. Finance Minister that continues positive measures has been taken to stabilize the market for long-run.

Global Positive Market News

- Crude Oil price decreased as Saudi Arabia efforts on restoration on Oil after a Drone attack.

- US declined on Trump impeachment concerts are here to stay. US-China trade war drama has a lack of clarity.

Forthcoming Events

- On Monday RBI monetary and credit review expected to release

- On Friday RBI will announce rate-cut

- On Wednesday India market is closed due to Gandhi Jayanti

- On Wednesday China market is closed due to National Day Golden Week

- China PMI data will be released on Monday

- US PMI data will be released on Tuesday

- Non-Farm USA and Oil Inventory data be released on Friday

- FED chairman speech on Friday

With huge number of Events & news expected for release in the upcoming week, the market will be volatile. But only a smart investor can benefit from the market volatile, through taking buying position around the support level and selling on resistance.

Exciting stock market updates for the upcoming week is that monthly, weekly, and daily support levels for the upcoming week are bullish.

Daily support level1 will be 11,469. Traders can buy trades if the market stays above level S1 and remain bullish. If weekly support level 2 is 10,995 which can be a 500 points slowdown in the level. Then traders willing to take loss should consider S2 as a stop-loss point.

Monthly support level 3 will be 10,960 for long positional traders. The market is expected to stay volatile for the upcoming week. Traders are advised to keep tight stop losses.

Conclusion

Here what you should know before market investing for the next week.

- Long positional traders should take bullish trades

- Short position traders should take bullish trades if market sustains above 11,469

- Avoid Short positions at current levels of 11500.

- First Buy the Sell strategy is advised as market is in Bulls territory with tight Stop Losses.

- NIFTY50 market range is expected to stay between the level of 11,300 – 11,900

Therefore, for the upcoming week, the market is expected to stay positive and stable.

Learn How to Predict With Stock Market Classes in Delhi

If you want to learn how to predict the stock market during intraday trading. Or want to uncover the day trading strategies, join IFMC Institute stock market classes at our centre at Laxmi Nagar, Lajpat Nagar, Vaishali, Ghaziabad. If you cannot attend stock market classes in Delhi NCR then you can try our online share trading course.

Online Stock Market Courses

Are you a working professional? Are you a housewife or retired person? Do you want to learn share trading, but cannot attend classroom classes? The online stock market courses are just for you. For a complete overview of the stock market, you can join our free stock market classes. Online courses are designed by NSE-certified technical analysts to help aspiring investors and traders to learn the stock market at home with online medium.

Watch Video