Do you want to become an independent trader? Are you looking for a shortcut to technical analysis? Do you want to trade accurately? If you are new to stock trading and want to learn sure shot ways to make profitable trade then join our upcoming Webinar session on Uni-Directional Trade Strategy (UDTS).

Stock market fascinates people from different walks of life. Majority of the trader’s investment in the market with a vision to make money. But most of them end up losing their hard-earned money blaming the market violate. In fact, the hard reality is that without trading knowledge it is difficult to make profitable traders. Finding the right books or course to study share trading can be overwhelming. IFMC Institute endeavours to help aspirants who want to learn to trade in the stock market by introducing diverse courses in stock trading. UDTS is one such program where any beginners can learn to trade from scratch. You don’t require any background knowledge on stocks, finance, or economics. Anyone above the age of 18+ can attend the UDTS strategies course to begin their journey in trading. It is a popular course in over 170 countries around the world. UDTS has crossed over 9 million views on IFMC Institute YouTube channel.

About Course

UDTS – copyright content by IFMC Institute is a bunch strategy for freshers to the stock market

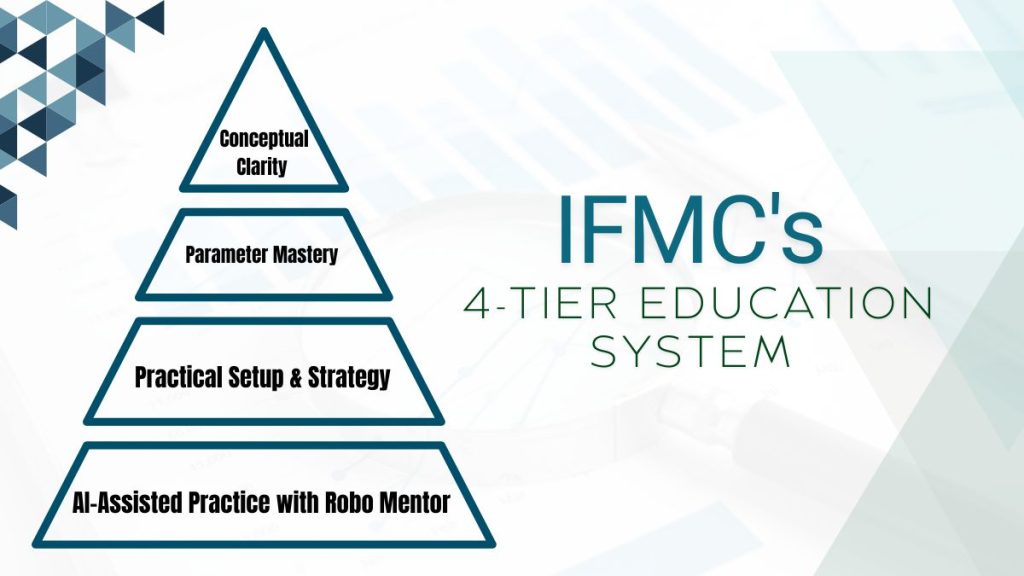

On the popular demand, we’re introducing the one-to-one online classes in Uni-Directional Trade Strategy. UDTS is a simplistic mechanism of trading. The strategy is simple to understand for beginners. You don’t require a knowledge of technical analysis or fundamental analysis. Its core focus on Intraday Trading, Positional Trading, and Long-Positional Trading. The course is divided into three parts.

- Basics: It covers the basics of stock trading, Rules of trading. Even if you are a beginner you can go ahead with this course.

- Analysis: How to Analyze Market Behaviour and Trends, so that one is able to get in trend. Make views Bullish or Bearish and confirm it using various parameters, so that when one trades he has no confusion.

- Applicability: Once you are aware of Technical tools and Fundamental aspects, one must know how to apply this knowledge in a live market and analyse it immediately and take necessary action to Buy, Hold, and Sell in the live market. Examples shown in videos in the live market will make you 100% sure about your trade and trading style.

To Book Your Slot Call: 9870510511

Batch Starting From – 27th September 2020

Who should attend?

- 10 , 10+ 2 students

- Graduates

- Working professionals

- Retired officers

- Housewives

- Retail investors or traders

- Brokers & sub-brokers

- Independent investors

Program highlights:

- IFMC is the award-winning and the biggest institute for the stock market

- UDTS is one of the most liked best stock trading course in the world

- Simple to understand the language

- Can be applied to commodity, equity, currency, crude, Gold and all other markets

- Gain confidence and accuracy to trade in the market

Course Outline

Lecture 1

How to become a successful trader

Difference between investor and trader

Lecture 2

Professional trading is an “art”, is a” technique”

Lecture 3

Rules of professional trading

Lecture 4

Making a short-term view (bullish or bearish ) through fundamentals.

Lecture 5

Making a short term view ( bullish or bearish) through technicals.

Lecture 6

Uni-Directional trade strategies

I – Intraday trade model (candle)

ii – Long-term positional model (candle)

iii – Positional trade model candle

iv – Short-term positional model candle

v – Long-term positional model line

vi – Positional model line

vii – Short-term positional model line

viii – Intraday model line

ix – Long term wealth creation through technical

UDTS Advance

UTDS Vs Technical Analysis Part 1

UTDS Vs Technical Analysis Part 2

UTDS Vs Technical Analysis Part

Uni-Directional Highlights

■ Candle Chart

■ Line Chart

■ Difference Between Investment & Trading

■ Art of Professional Trading

■ Rules of Stock Market Trading

■ Stock Market Trading View with Data & Event Analysis

■ Technical Analysis vs. UDTS

■ Concept of Stop Loss

■ Gap Up Gap Down Opening

■ Trend Analysis

■ Intraday Trade Model

■ Intraday Trading with Line Charts

■ Intraday Trading with Candle Charts

■ Short Positional onLine Charts

■ Short Positional on Candle Charts

■ Positional Trade Model

■ Positional Trading on Line Chart

■ Positional Trading on Candle Charts

■ Long Positional Trading on Line Chart

■ Long Positional Trading on Candle Charts

■ Daily Trend

■ Weekly Trend

■ Monthly Trend

■ Averaging of Traders

■ Commodity Trading

■ Currency Trading

■ Swing Trading

■ Momentum Trading

■ Long Term Wealth Creation Through Technical