Well, many get confused about the terms NISM and NCFM, especially those who wanted to build their career in the security market. Sometimes people also consider that these two terms are correlated. But they aren’t. However, both of the courses help people to establish basic and expert-level knowledge of the stock market. So, they can make their career in their particular respective field.

In this article, you’ll learn about the basic knowledge about NISM and NCFM and what is the major difference between NISM and NCFM. So, you don’t get confused while choosing the right certificate exam for you. But first, let’s see what these two terms are.

What are NISM and NCFM?

As discussed before, both certificate courses provide a better understanding of the stock market. So, the candidate can develop their career in their respective field, including the mutual fund industry, the stock market, and other fields. Also, people who want to gain knowledge about the financial market have to clear these exams.

NISM stands for National Institute of the Security Market. In contrast, NCFM full form is National Certification in Financial Market. Thus, a person must gain professional knowledge if the person is already working in the security market. Hence, these certified exams help people gain knowledge about the stock market and even the financial market.

What is the difference between the NCFM and NISM?

Well, there is only a slight difference as both are conducted by two different institutes. However, both the exams hold the same value. In other words, NCFM is held by the National Stock Exchange (NSE) while SEBI conducts NISM. However, there’s a difference between both the exam patterns.

The difference in NCFM and NISM exam pattern

Well, NCFM is a more robust and deeper exam as it encapsulates a wide range of finance topics. Generally, it only has 50 modules, which are further sub-categorized into three levels. These include Beginner, Intermediary, and Advanced levels. Normally, the topics that the NCFM exam covers include depositories, stock markets, banking, insurance, mutual funds, and more. Further, this exam is held online.

On the contrary, NISM has fewer modules compares to NCFM. NISM has 20 modules, which are also held online. But, in NISM, you’ll get a book of 200 pages for each module. The general topics that NISM Courses contains include mutual fund foundations, capital markets, derivatives market, depository operations, and more.

Well, it’s up to the student which exam they want to select. But, the earlier stage of both the exams provides only basic knowledge to the student. However, as the student moves to a higher stage, they receive expert-level knowledge. Even the Advanced level certifications program are very valuable.

NCFM Exam Details

NCFM exam consists of multiple-choice questions. Mostly the passing score of the exam is 50%, but in some cases, the candidate should score at least 60% to qualify for the exam.

Further, each module is different, such as the difference in the set of questions, duration of the exam, and many more. Generally, it consists of 60 questions that the candidate should have to complete in two hours.

In fact, some modules of this exam contain negative marking. Thus one should carefully give NCFM exams to avoid negative marking.

Moreover, the majority of the NCFM course certifications are valid for five years. But in some cases, it validates only three years, related to modules and dynamically changes in the area.

NISM Exam Details

As of now, more than 20 NISM exams are conducted to check the practical knowledge and proficiency required to manage Financial Markets. In fact, SEBI has made these certification courses mandatory for students seeking a career in such a field. Although some of the modules aren’t required for financial professionals, SEBI has made them compulsory to gain extra knowledge in their field.

However, if you’re looking to give NISM capital market exam, then there are two eligibility criteria that you should check. First, those who are already working in the stock and finance market and are professionals can give this exam. But, if you don’t belong to the finance domain then also you can give this exam. Second, the candidate must score at least 50% or 60% to qualify NISM certification exam.

But, this exam also considers a negative marking a minimum of 25% in most of the exams. So, you have to carefully attempt the exams in order to pass and get the NISM certificate.

How to Prepare for NISM and NCFM Certification Exam

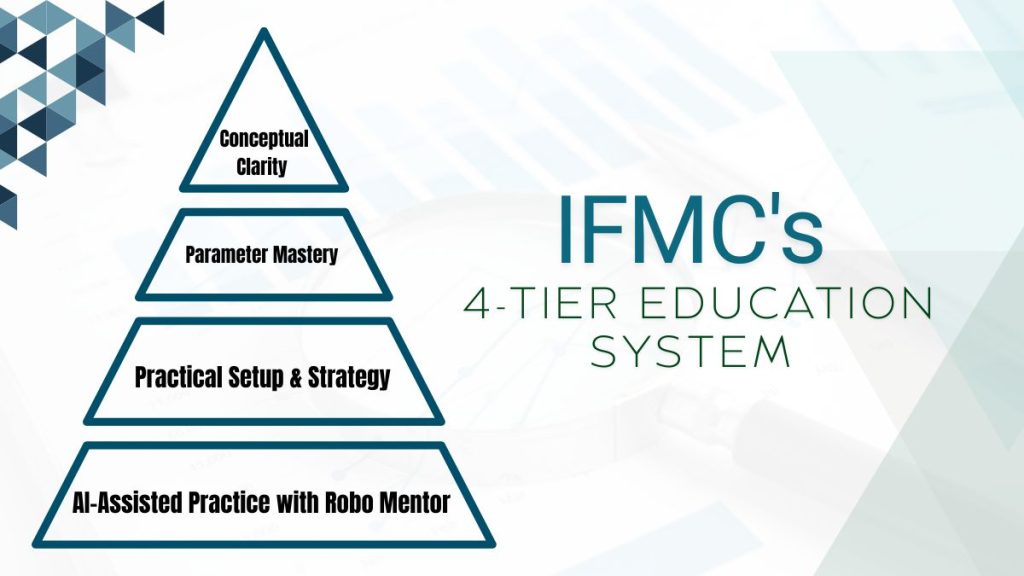

IFMC Institute certification program offers the best online preparatory certification course in NISM and NCFM certification exams. NISM and NCFM certification courses allow students who want to prepare for the exam to help them to get acquainted with the curriculum. We are dedicated to preparing students for upcoming jobs in the financial market but empowering them with the desired skills required to complete the task. These are the short-term online courses where students can access video tutorials from anywhere and anytime.

So, if you want to build a career as a stockbroker, or as an employee of a stockbroking firm, you need to get certified by NISM compulsorily. This certificate is required to enhance the service quality of financial advisory and related services in the financial service industry.

In short, if you’re looking to get advanced-level certification that can advance your career, then you should give the NCFM certification exam. Since NCFM exams often get updated as per the latest trends in the finance and stock market. If you’re looking to gain knowledge about the securities and financial market, you should give the NISM certification exam. So, it depends on the area you select; based on your field, you can select the certified exam.