Choosing the right stock market training institute shapes your learning speed, confidence, and outcomes. You want clear basics, practical tools, and teachers who trade. This guide shows why IFMC Institute is the best stock market training institute in India for beginners, college students, and working professionals. You will see the courses, who each course suits, expected outcomes, and how to enroll.

- Section 1: Why formal stock market training matters in India

- Section 2: Why IFMC Institute is the best stock market training institute in India

- Section 3: Courses at IFMC Institute and who they suit

- Section 4: Learning paths by learner type

- Section 5: What skills you build at IFMC Institute

- Section 6: Outcomes you can expect

- Section 7: Learning format and support

- Section 8: How IFMC courses compare with self-learning

- Section 9: Fees, duration, and who should enroll

- Section 10: Simple study playbook to follow

- Section 11: Common mistakes new traders make, and how IFMC helps you avoid them

- Section 12: Student reviews and success proof

- Section 13: How to choose the right course at IFMC

- Section 15: FAQs on stock market training in India

- Which is the best stock market training institute in India for beginners

- How long does it take to learn stock market trading

- Does IFMC offer online stock market courses

- Which course should I pick first

- Do I need prior experience or a finance degree

- Will I learn risk control

- Can I study while working full time

- Section 16: External resources

Section 1: Why formal stock market training matters in India

Most new traders learn by trial and error. That wastes time and money. A structured course gives you a step-by-step path.

You learn:

• Market basics, equity, derivatives, and mutual funds

• Order types, margin, risk, and settlement

• Chart reading, price action, and indicators

• Risk control, position sizing, and psychology

• Rules from exchanges and the regulator

With a curriculum, you avoid random advice and myths. You build a repeatable process. You also gain confidence to practice on real charts, backtest ideas, and track your performance.

- Start with the fundamentals in this beginner guide: Share Market Basics

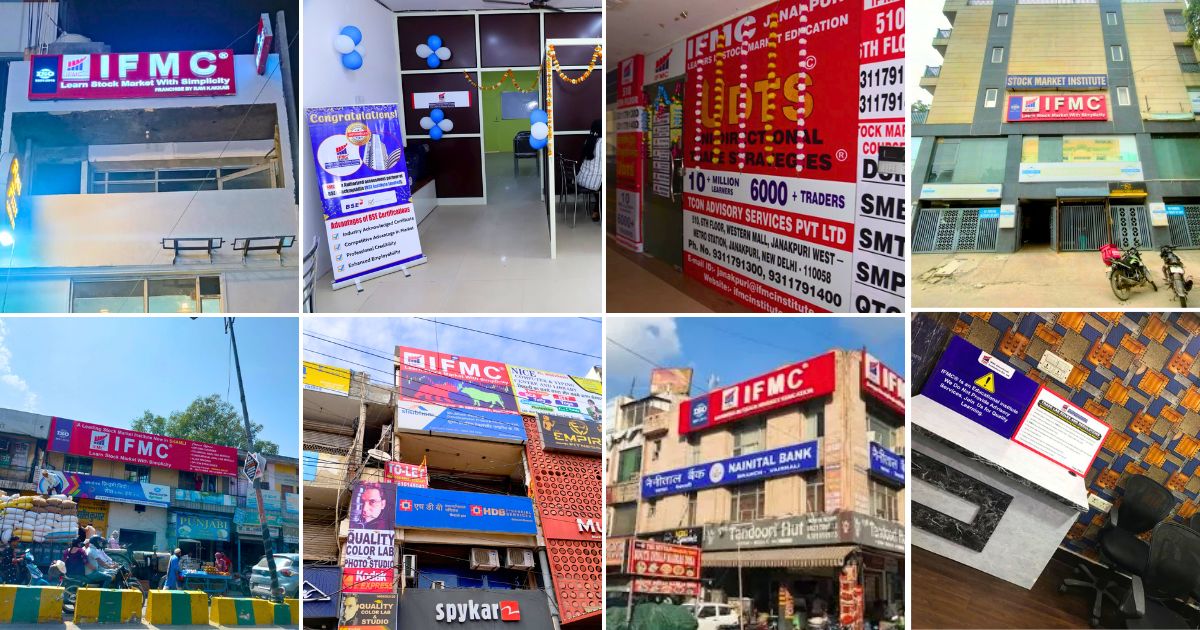

Section 2: Why IFMC Institute is the best stock market training institute in India

IFMC focuses on practical learning. Classes cover the full path from basics to live-market application. Trainers simplify concepts, then show examples on charts and market data.

What you can expect at IFMC:

- Beginner-friendly start, no prior experience needed

- Clear modules with outcomes and checkpoints

- Hands-on chart work and simple trading routines

- Recorded sessions for revision on select online programs

- Support channels for queries and guidance

- Both online and classroom options to suit your schedule

- About the institution and teaching approach: about IFMC Institute

- Explore online programs: Online Stock Market Courses

Ready to learn with a trusted institute across India?

- Enroll now with IFMC Institute

- Need guidance on the right course? Connect via the contact page for WhatsApp counseling:

Section 3: Courses at IFMC Institute and who they suit

Pick a course based on your current level, time, and goal. Below are flagship paths and how they help.

3.1 Certificate Course in Stock Market

Best for: absolute beginners, students, and professionals who want complete basics before moving to strategies.

What you learn:

- Market structure, participants, and instruments

- Demat, trading accounts, and order execution

- Equity market, IPO basics, and indices

- Mutual funds, ETFs, SIP methods

- Intro to risk control and investor behavior

Outcome: You become market-ready, understand core terms, and can track and invest with a plan.

3.2 Technical Analysis Course

Best for: new or aspiring traders who want to read charts and make rules-based decisions.

What you learn:

- Chart types, timeframes, and trend analysis

- Support, resistance, and supply-demand zones

- Indicators and oscillators with simple settings

- Price patterns and breakouts

- Entry, stop loss, and target frameworks

- Trading routine and journal basics

Outcome: You can build and follow a technical trading checklist for equities and indices.

3.3 Derivatives Market Course

Best for: traders who want clarity in futures and options with simple risk rules.

What you learn:

- Futures pricing, margins, and mark-to-market

- Call and put options, premiums, and Greeks basics

- Directional and hedging setups

- Spreads and risk-defined structures

- Position sizing and risk caps per trade

Outcome: You can trade or hedge with a clear plan and limited risk.

3.4 Online Course Path for Pan-India Learners

Best for: learners who need flexible timing or live outside major cities.

What you learn:

• Same core curriculum with recorded sessions where applicable

• Guided exercises and examples

• Regular check-ins and support channels

Outcome: You learn at your pace while keeping structure and accountability.

- Online Courses

- Choosing after graduation: stock market courses after graduation

Not sure which course fits your goal?

- Get quick help on WhatsApp via the contact page

- Or enroll directly to start learning in our online courses

Section 4: Learning paths by learner type

Use these paths to avoid guesswork. Follow the steps as given.

Path A: Beginners and students

Goal: learn basics, then try simple investing or paper trading.

Steps:

- Complete the Certificate Course in Stock Market

- Start a watchlist and track 10 to 20 stocks for a month

- Learn basic charts in the Technical Analysis Course

- Practice entries and exits on paper for 4 to 6 weeks

- Begin small with SIPs or low-risk investing while you keep learning

Path B: Working professionals

Goal: invest responsibly, add a basic trading routine if time allows.

Steps:

- Take the Certificate Course in Stock Market to build core confidence

- Add the Technical Analysis Course if you plan active trading

- Create a weekly routine, weekend analysis, weekday alerts

- Focus on risk, define a fixed loss per trade or per month

- Track results, cut methods that do not work, repeat the ones that do

Path C: Aspiring derivatives traders

Goal: learn futures and options with tight risk rules.

Steps:

- Start with the Technical Analysis Course for clear entries and exits

- Add the Derivative Market Course for F&O

- Use paper trading to test spreads and risk-defined structures

- Begin with small lots, keep a strict stop loss and daily loss cap

- Review monthly, remove ideas that add losses, keep only clean setups

Section 5: What skills you build at IFMC Institute

Your skills determine your outcomes. IFMC courses aim for these results.

Core skills:

• Market foundation and vocabulary

• Chart reading and trend recognition

• Simple setups that you can repeat

• Risk limits you will respect

• Trade journaling and review habits

• Psychology awareness, handling losses and wins

Practical exposure:

- Case studies and live chart examples

- Assignments and checklists

- Simple screeners and alerts

- How to avoid overtrading

Section 6: Outcomes you can expect

Outcomes vary by effort and consistency. With practice, most learners report:

• Improved clarity on when to enter and exit

• Better risk control and fewer impulsive trades

• A weekly routine that saves time

• A cleaner view of what works versus guesswork

How to Learn: Measure progress weekly. Use a journal. Track win rate, average win, average loss, and maximum drawdown. Try to keep a small average loss and a controlled drawdown.

Section 7: Learning format and support

You can learn in a way that suits your schedule.

• Online courses for flexible timing

• Classroom batches where available

• Recorded sessions on select programs

• Study notes, tasks, and quizzes

• Support channels for questions

• Simple email and WhatsApp touchpoints via the contact page

Section 8: How IFMC courses compare with self-learning

Self-learning can work, but it often lacks order. YouTube and forums can be noisy. A course gives structure, proven steps, and mentor support. You save time. You avoid common traps, like overusing indicators or chasing tips without rules.

Section 9: Fees, duration, and who should enroll

- Duration: typical modules range from a few weeks to a few months

- Study time: plan 5 to 7 hours a week if you work full-time

- Who should enroll: beginners, students, young professionals, and traders who want a rules-based approach

Section 10: Simple study playbook to follow

Keep your study plan tight and realistic.

Weekly plan example:

- 2 sessions of learning, 60 to 90 minutes each

- 1 session of chart review and journaling, 60 minutes

- 1 small assignment, like marking support and resistance on five charts

Monthly plan example:

- Finish one module

- Do a paper trading sprint for 10 sessions

- Review your trades, cut mistakes, and refine your checklist

Section 11: Common mistakes new traders make, and how IFMC helps you avoid them

Mistake 1: Using too many indicators

Fix: learn price structure first, use one or two tools to confirm.

Mistake 2: No stop loss and no position sizing

Fix: set a fixed loss per trade, like 0.5 to 1 percent of capital.

Mistake 3: Trading all day without a plan

Fix: pick one or two timeframes, a setup, and a routine.

Mistake 4: Chasing tips

Fix: use a checklist and your own analysis before every trade.

Mistake 5: No journal

Fix: log entries, exits, reason, result, and what you learned.

IFMC courses build these habits from day one.

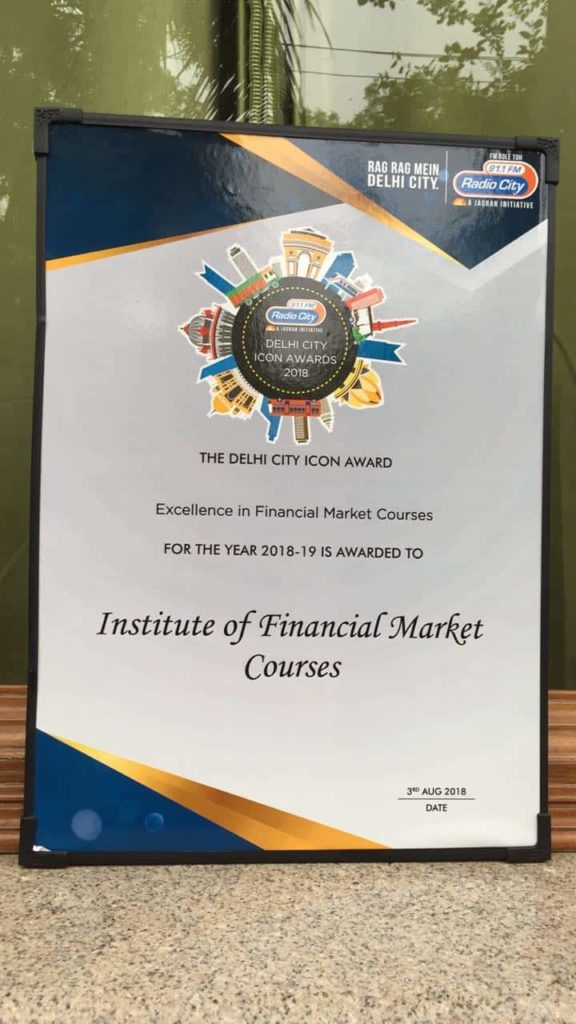

Section 12: Student reviews and success proof

Look for clarity in student feedback. Good reviews mention the flow of topics, easy explanations, chart practice, and support after class. You should also see references to real examples, not only theory.

Section 13: How to choose the right course at IFMC

Ask yourself:

- Do you want investing basics or trading skill, or both

- Do you have 4 to 8 hours a week to study

- Are you ready to follow a fixed risk cap

If you are new, start with the Certificate Course in Stock Market. If you want trading setups, add the Technical Analysis Course. If you want to work with futures and options, take the Derivative Market Course.

Section 14: How to enroll and get WhatsApp counseling

You can enroll online or ask for WhatsApp guidance.

- Browse and enroll in online courses

- Need WhatsApp help to choose a course, use the contact page to request a callback or WhatsApp counseling:

Section 15: FAQs on stock market training in India

Which is the best stock market training institute in India for beginners

IFMC Institute is a top choice for beginners who want clear basics, practical chart work, and a simple routine to follow.

How long does it take to learn stock market trading

Plan for a few months of guided learning and practice. Most learners need steady effort over 8 to 12 weeks to gain basic confidence.

Does IFMC offer online stock market courses

Yes. Learners across India can enroll in online courses with guided modules and support.

Which course should I pick first

If you are new, start with the Certificate Course in Stock Market. Add Technical Analysis for trading skills. For F&O, study the Derivative Market Course.

Do I need prior experience or a finance degree

No. The beginner path covers basics in simple language.

Will I learn risk control

Yes. Courses include stop loss, position sizing, and simple rules to control risk.

Can I study while working full time

Yes. Use the online path and the weekly plan example above.

Section 16: External resources

Use these official sources when you want to read more on rules and market structure.

- National Stock Exchange of India, education and certifications

- Securities and Exchange Board of India, investor education and regulations

- Major financial portals for market data and glossary