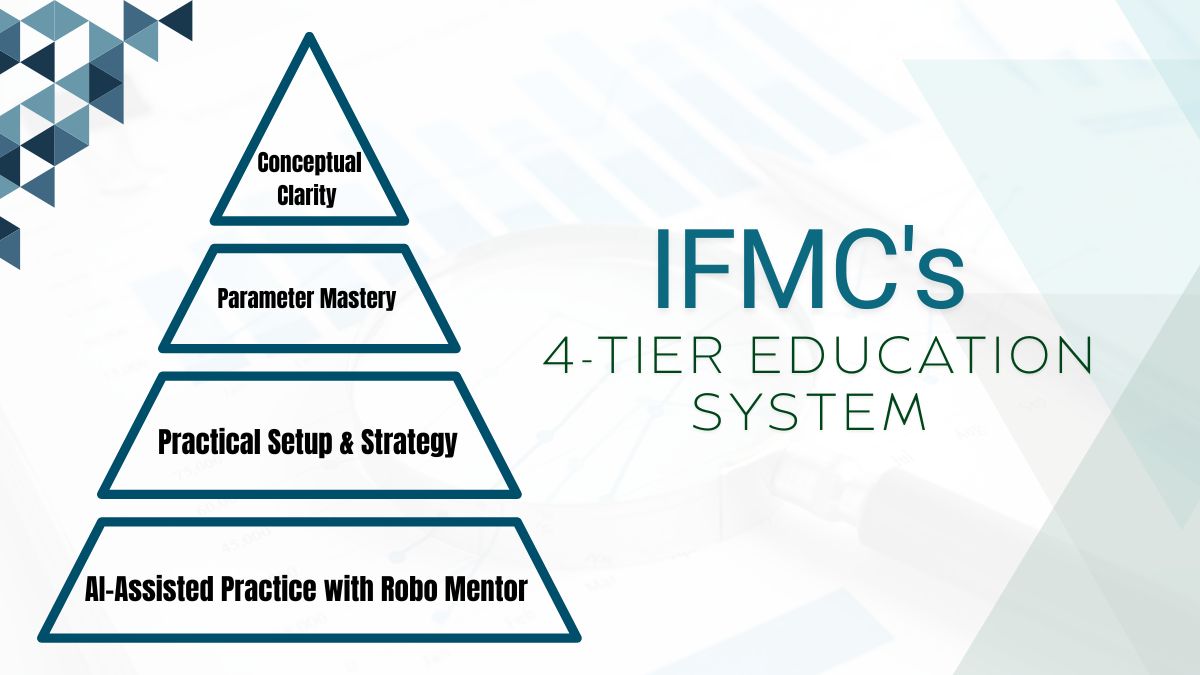

What is IFMC’s 4-Tier Education System?

IFMC Institute’s 4-Tier Education System is a comprehensive stock market education approach that transforms beginners into skilled traders through four progressive stages: Tier 1 focuses on Conceptual Clarity by building foundational understanding of technical and fundamental analysis principles, Tier 2 develops Parameter Mastery through deep learning of key market indicators and signals, Tier 3 applies Practical Setup & Strategy by creating real trading strategies and risk management techniques, and Tier 4 provides AI-Assisted Practice with a Robo Mentor for continuous skill development in live market conditions without financial risk. This structured progression addresses the common problem where 80% of retail traders lose money by ensuring students understand not just what to do but why they’re doing it, making IFMC’s system a proven path from market curiosity to professional-level trading competence that combines theoretical knowledge with practical application and ongoing AI-powered support for sustainable market success.

The financial markets can be intimidating territory for newcomers. Statistics show that approximately 80% of retail traders lose money in their first year, often because they jump into trading without proper education or structured learning. This sobering reality highlights a critical gap in traditional financial education approaches—most programs either overwhelm beginners with complex theory or throw them into practical scenarios without adequate foundational knowledge.

The Institute of Financial Market Courses (IFMC) recognized this challenge and developed something revolutionary: a comprehensive 4-Tier Education System that bridges the gap between theoretical knowledge and practical market success. This isn’t just another trading course—it’s a complete transformation journey that takes absolute beginners through a carefully structured progression, ultimately producing confident and competent market participants.

Understanding the Market Education Challenge

Before diving into IFMC’s solution, let’s examine why traditional approaches often fail. Most financial education programs fall into one of two categories: purely theoretical courses that leave students confused about real-world application, or hands-on programs that thrust beginners into complex scenarios without proper preparation. Neither approach addresses the fundamental learning progression that successful traders actually need.

Think of it like learning to drive a car. You wouldn’t start by immediately navigating busy highways during rush hour, nor would you spend months only reading about driving theory without ever touching a steering wheel. The most effective approach combines structured theoretical understanding with progressive practical application—exactly what IFMC’s 4-Tier System delivers.

The IFMC 4-Tier Education System: A Deep Dive

Tier 1: Conceptual Clarity – Building the Foundation

The journey begins with Conceptual Clarity, where IFMC focuses on something many programs overlook: the “why” behind market movements. Rather than simply teaching students to memorize chart patterns or economic indicators, this tier ensures deep understanding of fundamental principles.

Students explore the core concepts of both Technical Analysis and Fundamental Analysis in an integrated manner. Technical Analysis teaches them to read market sentiment through price action, volume patterns, and chart formations. Meanwhile, Fundamental Analysis helps them understand how economic factors, company performance, and market psychology drive these technical patterns.

This dual approach is crucial because successful trading requires understanding both the quantitative signals the market provides and the underlying economic forces that create those signals. A student might learn, for example, not just that a “head and shoulders” pattern often signals a trend reversal, but why this pattern emerges psychologically when buyer enthusiasm wanes and seller pressure increases.

The emphasis on conceptual clarity ensures that students don’t become mechanical pattern-followers but develop the analytical thinking skills necessary for adapting to changing market conditions. This foundation becomes the bedrock upon which all subsequent learning builds.

Tier 2: Parameter Mastery – Decoding Market Signals

With solid conceptual understanding in place, students advance to Parameter Mastery, where they learn to work with the specific indicators and metrics that drive real-time trading decisions. This tier transforms theoretical knowledge into practical analytical skills.

Students master key technical indicators such as moving averages, RSI, MACD, Bollinger Bands, and volume indicators, but more importantly, they learn when and why to use each tool. They discover how different indicators complement each other and how to combine multiple signals for more reliable decision-making.

The parameter learning phase also covers fundamental metrics like P/E ratios, debt-to-equity ratios, earnings growth rates, and sector-specific indicators. Students learn to evaluate these parameters not in isolation, but as part of a comprehensive analysis framework.

This tier addresses a common problem in market education: indicator overload. Many new traders try to use dozens of indicators simultaneously, creating confusion and contradictory signals. IFMC’s approach teaches students to master a focused set of reliable parameters and understand their interrelationships, leading to clearer and more confident analysis.

Tier 3: Practical Setup & Strategy – Where Theory Meets Action

The third tier represents the crucial transition from understanding markets to actually participating in them. Here, students learn to create and implement actual trading setups and investment strategies using their accumulated knowledge.

This phase covers strategy development, including how to identify trading opportunities, set entry and exit points, manage risk through position sizing and stop-losses, and develop the discipline necessary for consistent execution. Students work with real market scenarios, learning to apply their analytical skills to current market conditions.

The practical setup phase also introduces students to different trading styles and time horizons. They explore day trading strategies for those interested in short-term opportunities, swing trading approaches for intermediate-term positions, and long-term investment strategies for wealth building. This exposure helps students identify their preferred trading style based on their personality, risk tolerance, and time availability.

Risk management receives particular emphasis in this tier because it’s often the difference between long-term success and failure in trading. Students learn position sizing techniques, diversification strategies, and the psychological aspects of managing winning and losing trades.

Tier 4: AI-Assisted Practice with Robo Mentor – Continuous Learning Support

The fourth and most innovative tier extends learning beyond the formal course completion. IFMC provides access to an AI-powered Robo Mentor that offers ongoing support and practice opportunities in live market conditions without financial risk.

This AI system allows students to test their strategies, experiment with new approaches, and continue building their skills in a safe environment. The Robo Mentor can simulate various market scenarios, provide feedback on trading decisions, and help students identify areas for improvement.

The continuous learning aspect addresses a critical gap in traditional education programs. Markets are dynamic, constantly evolving environments where learning never truly ends. New patterns emerge, economic conditions change, and trading technologies advance. The AI-assisted practice ensures that IFMC graduates continue developing their skills long after course completion.

The Science Behind Progressive Learning

IFMC’s 4-Tier System aligns with established principles of adult learning and skill development. Educational research shows that complex skills are best acquired through scaffolded learning—a process where each new concept builds upon previously mastered material.

The tier progression follows what psychologists call the “competence hierarchy”: unconscious incompetence (not knowing what you don’t know), conscious incompetence (recognizing knowledge gaps), conscious competence (applying skills with effort), and unconscious competence (automatic skill application). Each tier addresses a different stage in this progression.

The system also incorporates spaced repetition and practical application, two techniques proven to enhance long-term retention and skill transfer. Students don’t just learn concepts once and move on; they repeatedly apply and refine their understanding through each tier.

Real-World Applications and Outcomes

The effectiveness of this structured approach becomes evident in real-world applications. Graduates of IFMC’s program report significantly higher success rates compared to self-taught traders or those who completed traditional courses.

The progression from conceptual understanding through practical application creates traders who can adapt to different market conditions rather than relying on rigid formulas. They understand not just what to do, but why they’re doing it, enabling them to modify their approach as markets evolve.

The AI-assisted practice component provides a particular advantage, allowing graduates to safely experiment with new strategies and maintain their skills during various market cycles. This ongoing support addresses one of the biggest challenges in trading education: the gap between classroom learning and real-world application.

Beyond Individual Success: Building Market Literacy

IFMC Institute’s comprehensive approach serves a broader purpose than just creating successful individual traders. By providing thorough, structured education, the program contributes to overall market literacy and stability.

Well-educated market participants make more informed decisions, are less susceptible to market manipulation, and contribute to more efficient price discovery. This benefits the entire financial ecosystem, creating a more rational and stable market environment for all participants.

The program’s emphasis on risk management and disciplined decision-making also helps prevent the kind of excessive speculation that can lead to market bubbles and crashes. Educated traders understand the importance of position sizing, diversification, and emotional discipline—principles that contribute to market stability.

The Future of Financial Education

IFMC Institute’s 4-Tier System represents an evolution in financial education, moving beyond traditional lecture-based approaches to create a comprehensive learning ecosystem. The integration of AI technology for ongoing support points toward the future of professional development in finance.

As markets become increasingly complex and technology-driven, the need for structured, comprehensive education becomes even more critical. Programs like IFMC’s 4-Tier System provide a model for how financial education can evolve to meet these challenges.

The success of this approach suggests that the future of financial education lies not in choosing between theoretical knowledge and practical application, but in thoughtfully integrating both within a progressive learning framework that supports students throughout their development journey.

Conclusion: A Complete Transformation Journey

IFMC’s 4-Tier Education System represents more than just a course—it’s a complete transformation process that takes curious beginners and develops them into confident, competent market participants. By addressing the full spectrum of learning needs from conceptual understanding through ongoing skill development, the program provides a roadmap for sustainable success in financial markets.

The structured progression ensures that students build genuine expertise rather than just superficial knowledge. They learn not just what successful traders do, but how they think, how they approach problems, and how they continue growing throughout their careers.

For anyone serious about developing real competence in financial markets, understanding this comprehensive approach to education provides valuable insights into what genuine market education should look like. The 4-Tier System demonstrates that with proper structure, support, and progression, anyone can develop the skills necessary for market success.

The transformation from market novice to trading professional isn’t magic—it’s the result of systematic, progressive education that builds real understanding and practical capability. IFMC’s 4-Tier System provides exactly this kind of comprehensive development, making it a model for excellence in financial market education.

Frequently Asked Questions About IFMC’s 4-Tier Education System

How long does it take to complete IFMC’s 4-Tier Education System?

The duration varies depending on the specific course you choose and your learning pace, but most students complete the core 4-tier program within 3-6 months. The structured progression allows you to move through each tier systematically, ensuring thorough understanding before advancing. The final tier with AI-assisted practice continues indefinitely, providing ongoing support throughout your trading journey.

What qualifications do I need to start IFMC’s 4-Tier program?

No prior financial background is required to begin the program. The system is specifically designed to take complete beginners through a comprehensive learning journey. Whether you’re a fresh graduate, working professional, or someone looking to change careers, the Tier 1 foundation ensures everyone starts with proper conceptual clarity regardless of their starting knowledge level.

How does IFMC’s approach differ from other stock market courses?

Unlike traditional courses that focus either purely on theory or jump straight into trading strategies, IFMC’s 4-Tier System provides a progressive learning structure. Most courses teach what to do, but IFMC emphasizes understanding why markets move the way they do. The integration of AI-assisted practice in Tier 4 also sets it apart, offering continuous learning support that most other programs don’t provide.

Can I practice trading without risking real money during the course?

Yes, the Tier 4 AI-assisted practice with Robo Mentor specifically addresses this need. You can test strategies, experiment with different approaches, and continue building skills in live market conditions without any financial risk. This safe learning environment allows you to gain practical experience and build confidence before committing real capital to trading.

Is IFMC’s 4-Tier system suitable for both beginners and experienced traders?

Absolutely. While the system starts from foundational concepts in Tier 1, even experienced traders benefit from the structured approach to parameter mastery and strategy development in subsequent tiers. Many experienced traders have gaps in their understanding or use ineffective approaches, and the comprehensive system helps identify and address these issues systematically.

What kind of ongoing support does IFMC provide after course completion?

The Tier 4 AI-powered Robo Mentor provides continuous post-course support, allowing graduates to practice in live market conditions, receive feedback on trading decisions, and continue developing their skills. This ongoing support system ensures that learning doesn’t stop when the formal course ends, addressing the common problem of skills deterioration after traditional course completion.

How does the AI-assisted practice actually work?

The Robo Mentor uses artificial intelligence to simulate various market scenarios and provide real-time feedback on your trading decisions. It can present you with different market conditions, help you practice strategy implementation, and identify areas where you need improvement. The AI system learns from your responses and adapts to provide increasingly sophisticated practice scenarios as your skills develop.

Can I get certified through IFMC’s program?

Yes, IFMC offers various NSE, BSE, NISM, NCFM, and SEBI-based certification preparation as part of their comprehensive education approach. The 4-Tier System prepares you thoroughly for these industry-standard certifications, and IFMC provides mock tests and exam preparation modules to ensure you’re ready for certification exams.

What trading strategies does IFMC teach in their 4-Tier system?

The program covers IFMC’s proprietary Uni-Directional Trading Strategies (UDTS) and Market Analysis by Data and Event (MADE) approaches, along with fundamental technical and fundamental analysis techniques. Rather than teaching rigid formulas, the system helps you understand the principles behind successful strategies so you can adapt to changing market conditions.

How much does IFMC’s 4-Tier Education System cost?

Course fees vary depending on the specific program level and duration you choose. IFMC offers different course packages to accommodate various budgets and learning needs. The investment includes access to all four tiers, ongoing AI-assisted practice, and comprehensive support materials, making it a complete educational ecosystem rather than just a single course.