Open interest shows you how many futures and options contracts are open in the market. It helps you understand activity, strength, and participation in derivatives trading. If you learn how to read it, you can make better trading decisions.

- What Open Interest Means

- How Open Interest Works

- Example With Simple Numbers

- Open Interest vs Volume

- Why Open Interest Matters for Beginners

- Signals You Can Read From Open Interest

- Common Myths About Open Interest

- How to Use Open Interest in F&O Trading

- For Better Learning

- External Resources You Can Use

- FAQs

- Final Words

What Open Interest Means

Open interest counts the total number of active contracts. These contracts are not squared off yet. They remain open until traders close, exercise, or expire them. Higher open interest shows stronger activity. Lower open interest shows weaker participation.

How Open Interest Works

Open interest goes up when new buyers and sellers enter the market. It goes down when both sides close their positions. If one trader opens a fresh contract and another trader also opens a fresh contract, open interest increases by one. If both traders close their positions, open interest decreases by one.

Example With Simple Numbers

If the market shows 5,000 open contracts today and 6,200 tomorrow, open interest increased by 1,200. This tells you that fresh money entered the market. If it drops from 6,200 to 4,800, it signals that traders are exiting positions.

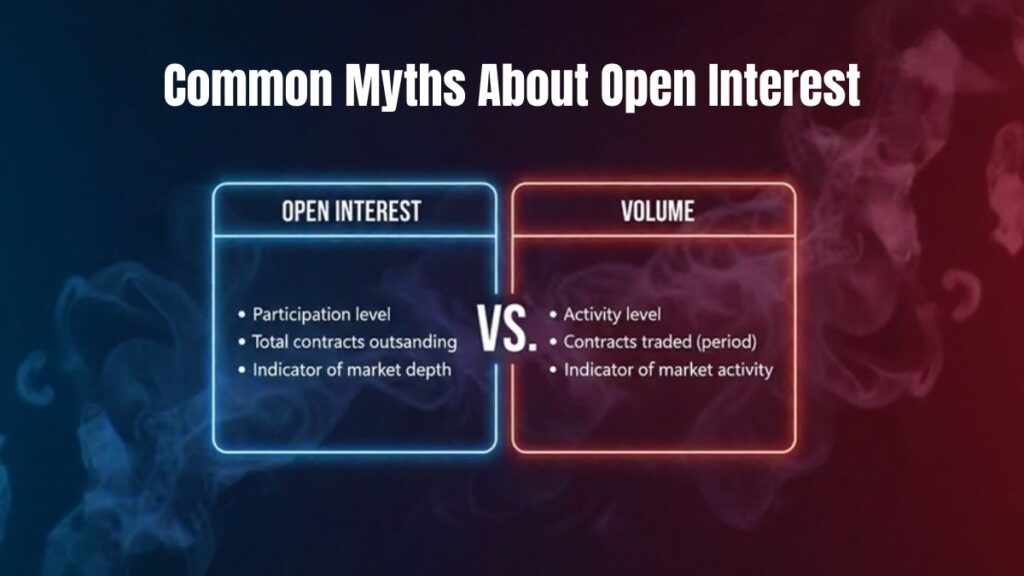

Open Interest vs Volume

Open interest counts total open contracts.

Volume counts the number of contracts traded during the day.

Key points

- Open interest tracks activity over days.

- Volume tracks activity during the day.

- Open interest rising with volume rising shows strong market interest.

- Open interest falling with volume rising can show profit booking.

Why Open Interest Matters for Beginners

You can use open interest to understand trend strength. It helps you judge whether traders support a price move. Use it to avoid guessing during volatile sessions. It also helps you filter strong setups in futures and options trading.

Signals You Can Read From Open Interest

Use these four simple signals.

- Price up and open interest up. Trend looks strong.

- Price down and open interest up. Selling looks strong.

- Price up and open interest down. Trend can weaken.

- Price down and open interest down. Selling pressure can ease.

These signals help you judge sentiment without complex formulas.

Common Myths About Open Interest

Many beginners think open interest shows future price direction. It does not. Open interest only shows participation. Traders often mix open interest with volume. Treat them as separate data points. Use both for a clearer view.

How to Use Open Interest in F&O Trading

You can use open interest to spot

- Strong trends

- Weak breakouts

- Short covering

- Long unwinding

- High interest near support and resistance

Look for price and open interest moving together. This gives you a cleaner view of trader behaviour.

For Better Learning

- If you want to build a strong base, start with the Stock Market Course for Beginners. It helps you understand the market in clear steps.

- Learn chart reading, patterns, and indicators through the Technical Analysis Course. It supports your F&O learning.

- Build your financial knowledge with the Fundamental Analysis Course. It helps you understand how companies create value.

External Resources You Can Use

You can check open interest on NSE and BSE websites. These platforms update data in real time. Many traders use this data to track market sentiment.

FAQs

What does open interest tell traders

Open interest shows you the strength of participation. It helps you judge how much money is active in a particular contract.

How is open interest calculated

Each pair of new buyer and seller adds one contract. Each pair that closes reduces one contract.

Is open interest useful for beginners

Yes. Beginners can use open interest to confirm trends, spot strength, and avoid false moves.

What is the difference between volume and open interest

Volume tracks daily trades. Open interest tracks total open contracts.

Can open interest predict price movement

No. It cannot predict future prices. It only shows participation. Use it with price action for better decisions.

Final Words

Open interest helps you read the market with more confidence. It improves your understanding of futures and options. Once you learn how it works, you can judge strength, sentiment, and participation with more clarity.