Online trading means buying and selling financial instruments like stocks, commodities, and currencies through the internet. Instead of calling a broker or visiting an office, you can now trade from your phone or computer.

It’s quick, simple, and affordable, which is why millions of Indians have started investing online.

If you’re new to the stock market, this guide will help you understand what online trading is, how it works, and how to begin safely.

How Does Online Trading Work?

Online trading works through electronic platforms connected to the stock exchanges. Here’s the basic process:

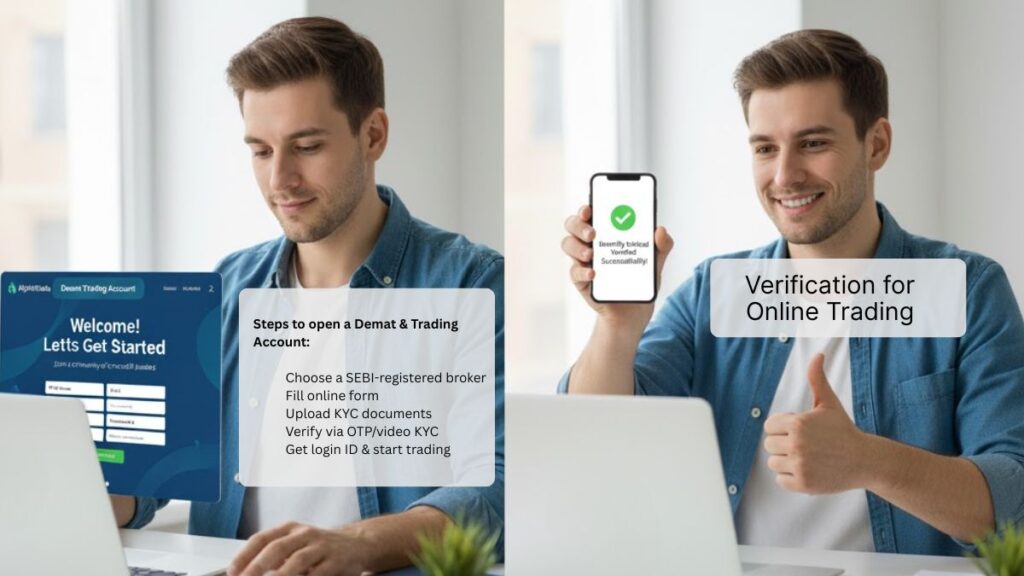

- Open a Demat and Trading Account: You need both to buy and sell shares.

- Deposit Funds: Transfer money from your bank account to your trading account.

- Choose a Stock or Asset: Use a trading app or platform to pick what you want to buy.

- Place an Order: Decide the price and quantity, then execute the trade.

- Monitor Your Portfolio: Track your holdings and profits in real time.

Everything happens digitally, from execution to settlement. You can trade anytime during market hours without needing a middleman.

Benefits of Online Trading in India

Online trading gives you full control over your investments. Here are the main benefits:

- Convenience: Trade from home or anywhere using a smartphone or laptop.

- Transparency: Get live market prices and instant order updates.

- Low Cost: Online brokers charge lower fees compared to traditional brokers.

- Real-Time Access: See price movements, charts, and market news instantly.

- Portfolio Management: Track your assets and returns with built-in analytics tools.

Online trading platforms also allow you to automate orders, set alerts, and use charts for analysis.

Types of Online Trading

There are several kinds of trading you can do online depending on your interest and risk level.

1. Equity Trading

Buy and sell company shares listed on NSE or BSE. Ideal for beginners.

Know more about equity trading in our classroom equity trading classroom course

2. Commodity Trading

Trade in goods like gold, silver, crude oil, or agricultural products.

Know more about commodity trading in our classroom commodity trading classroom course

3. Derivatives Trading

Trade futures and options to speculate or hedge against price movements.

Know more about derivatives trading in our classroom derivatives trading classroom course

4. Currency Trading

Trade foreign exchange pairs like USD/INR or EUR/INR.

Know more about currency trading in our classroom currency trading classroom course

5. Intraday and Delivery Trading

Intraday means buying and selling within the same day. Delivery trading means holding your stocks for longer.

Know more about intraday trading in our classroom intraday trading classroom course

What You Need to Start Online Trading

Before you start, ensure you have:

- PAN Card and Aadhaar Card for KYC verification.

- Bank Account linked to your trading account.

- Reliable Broker or Trading Platform registered with SEBI.

- Basic Stock Market Knowledge to understand how trades and prices work.

- Internet Connection and Device to use your trading app smoothly.

Once your account is active, you can start small and learn with experience.

Learn Online Trading with IFMC Institute

Learning online trading is easier when you follow a structured course.

IFMC Institute offers a step-by-step Online Trading Course designed for beginners.

You’ll learn how to:

- Use a trading platform

- Understand charts and indicators

- Manage risk

- Build trading discipline

You can watch a free demo before you enroll to understand how the course works.

If you want to go deeper, explore other courses like:

These courses are available online with lifetime access, helping you build a strong foundation in stock trading.

Common Mistakes Beginners Should Avoid

Many new traders lose money because they rush in without preparation. Avoid these common errors:

- Trading without research or plan

- Ignoring stop-loss orders

- Following market rumors

- Investing borrowed money

- Trading emotionally after losses

A little patience and education can help you avoid costly mistakes.

Is Online Trading Safe in India?

Yes, online trading is safe when you use registered platforms and follow security measures.

Make sure your broker is approved by SEBI and NSE/BSE.

Always use secure passwords and avoid sharing your login details.

Never install trading apps from unknown sources.

You can check broker authenticity on SEBI’s official website.

FAQs on Online Trading

What is online trading?

Online trading is the process of buying and selling stocks, commodities, or currencies using an internet-based platform instead of traditional offline brokers.

How can beginners start online trading in India?

Open a Demat and trading account with a SEBI-registered broker, link your bank account, and start learning through a certified course like IFMC’s Online Trading Course.

What is the minimum amount to start online trading in India?

You can start with as little as ₹500 to ₹1,000, depending on your broker and the stock price.

Can I trade without a broker?

No. You need a broker registered with SEBI to access the stock exchanges legally.

Is online trading safe?

Yes, as long as you trade through authorized brokers and use secure trading platforms.

Conclusion

Online trading has made investing simple and accessible for everyone.

With the right knowledge and a disciplined approach, you can start your trading journey confidently.

IFMC Institute’s Online Trading Course helps you build that confidence with real-world learning and practical strategies.

Watch free demo today and take your first step into the world of online trading.