Alpha tells you how much a stock or portfolio beat or lagged its expected return after adjusting for risk. Positive alpha means outperformance. Negative alpha means underperformance. If you are new, start with the Stock market basics to place alpha in context.

Simple meaning for beginners

Alpha is the extra return over what you should have earned for the risk you took. If the model says 10 percent and you earned 12 percent, alpha is +2 percent.

The alpha formula in one line

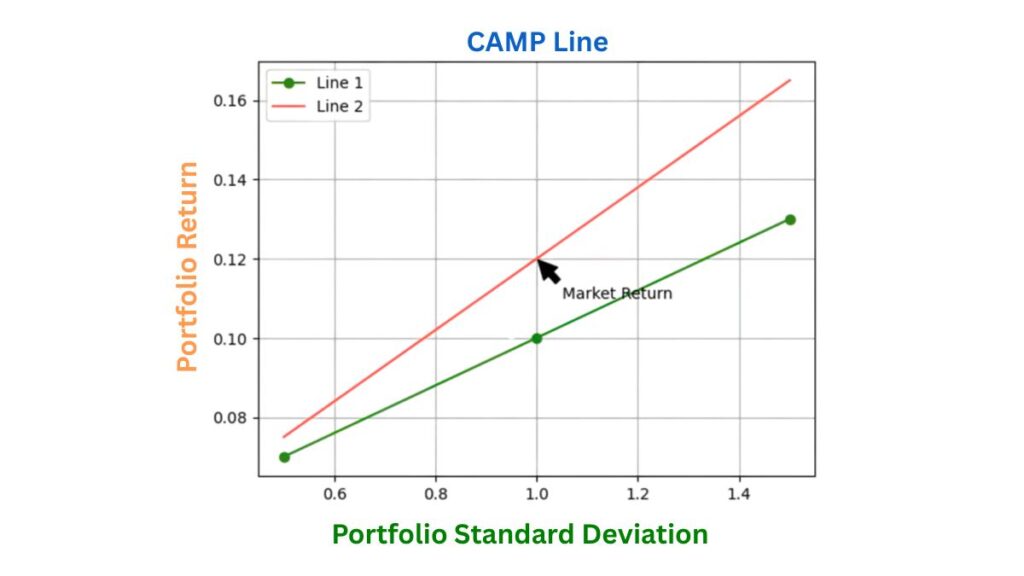

Alpha = Actual return − Expected return from CAPM

CAPM expected return = Risk-free rate + Beta × (Market return − Risk-free rate)

You can read the Stock market terms glossary for quick definitions of beta, market return, and risk-free rate.

Example, step by step

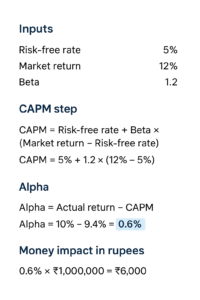

Inputs

- Invested amount = ₹1,00,000

- Actual portfolio return, Rp = 14 percent in the year

- Risk-free rate, Rf = 6 percent

- Market return, Rm = 10 percent

- Portfolio beta, β = 1.2

Step 1, expected return with CAPM

Expected = 6% + 1.2 × (10% − 6%) = 10.8%

Step 2, alpha

Alpha = 14% − 10.8% = +3.2%

What it means in money

- Expected gain = ₹1,00,000 × 10.8% = ₹10,800

- Actual gain = ₹1,00,000 × 14% = ₹14,000

- Extra gain due to alpha ≈ ₹3,200

One more quick example

You invested ₹2,50,000.

- Expected return = 9 percent

- Actual return = 7 percent

Alpha = 7% − 9% = −2%

Approximate shortfall = ₹2,50,000 × 2% = ₹5,000

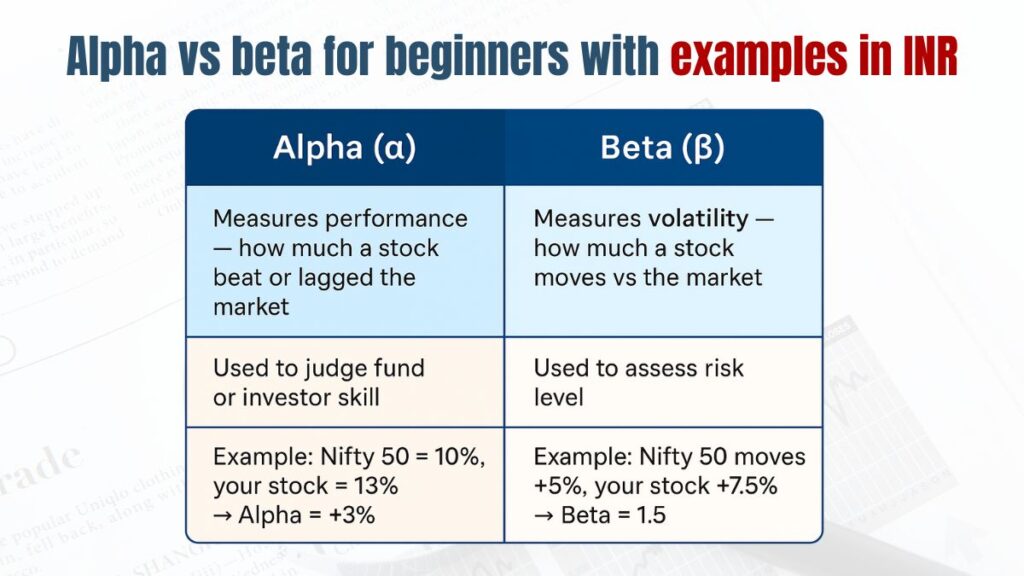

Alpha vs beta, when each matters

- Alpha measures skill after risk. You want it positive and consistent.

- Beta measures sensitivity to market moves. Beta near 1 moves like the market. Higher than 1 moves more. Lower than 1 moves less.

- Use beta for risk control. Use alpha to judge value added.

How beginners in India can use alpha

- Comparing mutual funds or PMS. Check alpha in the factsheet across 3 to 5 years.

- Reviewing your own picks. Track alpha against the right benchmark index.

- Core-satellite plan. Keep index funds for beta. Add a small satellite for strategies that aim for alpha.

- Manage costs. Fees and taxes reduce realized alpha.

Limits you should know

- Wrong benchmark gives fake alpha. Match large cap funds with Nifty 100, small cap with small cap index.

- Beta changes over time. Recheck annually.

- CAPM is a single-factor model. Add Sharpe or Sortino for a fuller view.

- Past alpha can fade. Look for process, not luck.

Helpful reads

Ready to learn with mentors and practice live examples

- Join the Diploma in Research Analyst to master practical valuation, risk, and performance metrics.

- Prefer a broader path, see the Advanced Diploma in Financial Markets.

- Need basics first, start from Stock market basics.

FAQs

Is alpha annualized

Yes. Most Indian fund factsheets show annualized alpha. Check the period before you compare.

What is a good alpha

Above zero is a start. Look for consistency across years and net of fees.

Can index funds have alpha

They target market return. Any alpha is small and random.